Innovation ecosystems that support clean energy entrepreneurs are emerging across the world. The opportunity for linking expertise, capabilities, and investment activities across these ecosystems is becoming apparent through innovation intermediaries like accelerators (e.g. Free Electrons). Similarly, Australian companies are taking advantage of these connected ecosystems, and government is aiming to better link Australian entrepreneurs with external partners, and external partners with the Australian energy ecosystem. However, these landscapes and connections through open innovation processes, for example, are not well understood as yet. As two economies exploring different models for clean energy entrepreneurship, and international linkages, Australia and Germany pose an interesting opportunity for exploring improved open innovation connection.

There is a need to better understand 1) the state of play for clean energy entrepreneurial ecosystems in Australia-Germany; 2) how these ecosystems are/could be connected; and 3) the policy and industry opportunities that such connection would bring.

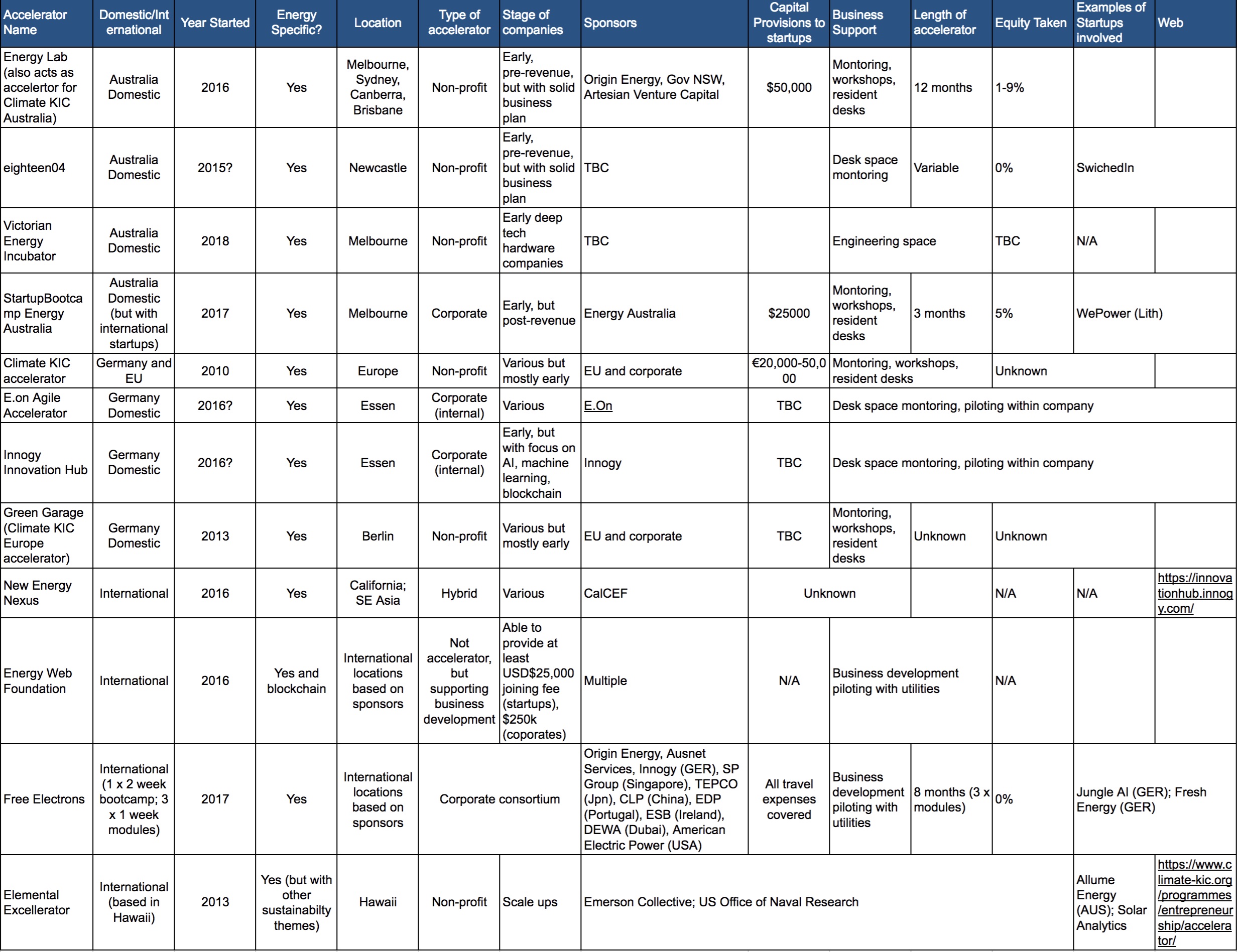

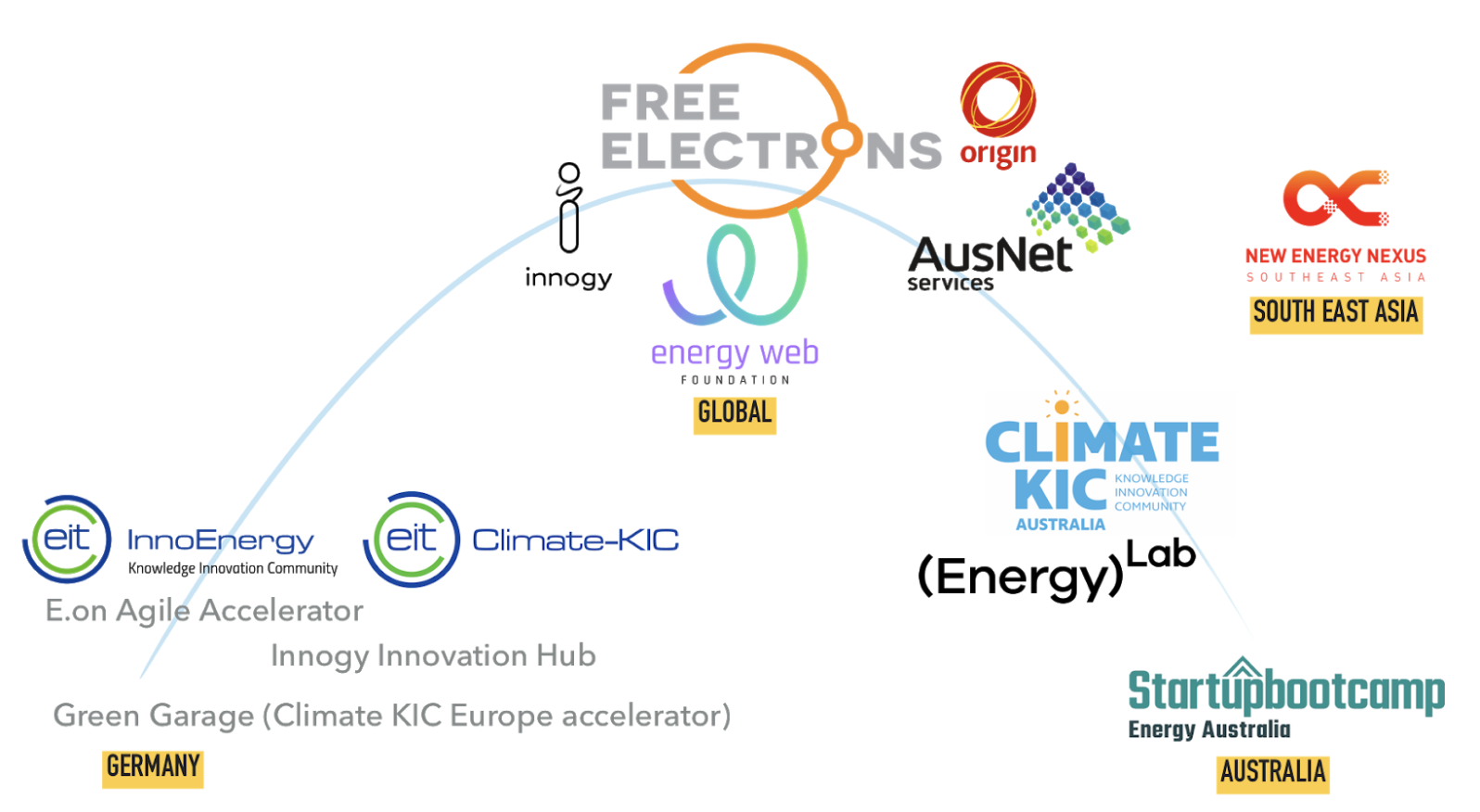

This research maps the clean energy innovation and entrepreneurship ecosystem in Australia and Germany, with a focus on innovation galvanised by innovation intermediaries (i.e. incubators, accelerators, spatially defined innovation systems) and provide case studies to explain current expertise, capabilities, and investment, in specific ecosystems.

Clean Energy Entrepreneurship: Overview and context

Within the context of government, civil society, and industry, multiple interrelated factors influence how a technology ecosystem development occurs. Innovation and entrepreneurship antecedents and outcomes are intertwined, and the clean energy response to climate change experiences significant scientific, policy, and social complexity. As such, although entrepreneurs are playing an increasingly important role in providing new technologies and new business models to help the energy ecosystem evolve, there remain significant challenges to enabling a fully-fledged industrial entrepreneurial energy ecosystem. This report highlights the technology, investment, and ecosystem opportunities and challenges for clean energy entrepreneurs in Australia and Germany.

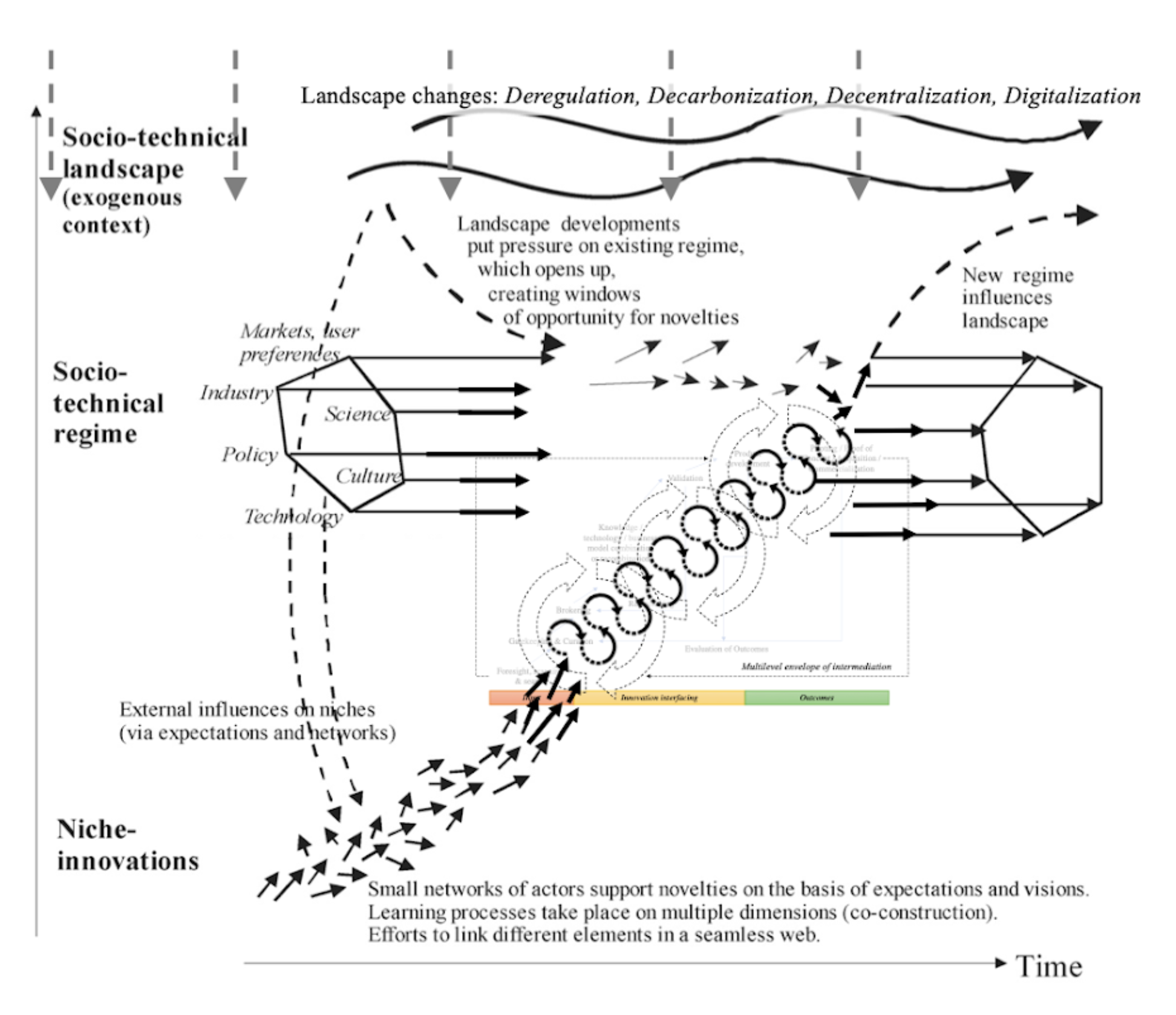

A critical element of clean energy entrepreneurship is to assist in the development and diffusion of clean transportation technologies, augmentation of ecosystem services that sequester and process greenhouse gases, and the rapid decarbonisation of the electricity system. At a structural level, the decarbonisation of the electricity system poses the most important immediate challenge. It is also the system currently facing rapid disruption. Three main drivers are shaping global electricity systems: decarbonization, decentralization and digitalization. Deregulation and democratisation of energy are also ‘D’s that fall into the list. From the Paris Climate Agreement down to the municipal level, regulations, standards, goals, incentives and support mechanisms are reducing the carbon intensity of electricity grids.

As a result, across the globe, traditional energy frameworks are witnessing a fundamental shift. Technologies are being enabled by new finance; private-sector investment is playing a significant role as these new systems take shape, both from traditional utilities—many of which are seeing this new way forward as an opportunity rather than as disruption—and from the start-ups and entrepreneurs developing and applying new technologies in the renewables space (GII 2018). And entrepreneurial ecosystems are developing to support nascent clean energy innovations heralded by entrepreneurs.

Better understanding entrepreneurial ecosystems is, therefore, important to further enable the commercialisation of basic research, collaboration between emerging companies and incumbent players, and facilitate effective deployment of domestic and international early stage capital. For energy entrepreneurship, a sector characterised by high levels of incumbency, deep valleys of death for startups, and limited traditional early stage capital provision, supporting entrepreneurial ecosystems is a critical component of their development.

The state of play in clean energy entrepreneurship and innovation.

"Sustainable energy innovation flourishes in virtual networks and physical systems that cross national borders and involve multiple actors, from established companies and start-ups to academic and government institutions. Catalysts for innovation, such as regulatory policies, public funding programmes and innovation alliances, regulate and influence the system’s enabling frameworks, which also contain inherent deficiencies or weaknesses that create barriers for sustainable energy innovations" (World Economic Forum, 2018, p. 11)

Entrepreneurs play a critical role in the formation of an effective innovation ecosystem. Startup companies are the dual engines of innovation and commercialisation of breakthrough ideas, alongside larger commercial entities, taking technology from Technology Readiness Levels (TRL) 3 (proof of concept) to 7 (full scale demonstration in a relevant environment).

Clean energy entrepreneurship is a response to the opportunity to create business models that address the challenge of climate change. Entrepreneurs in clean energy aim to seek out profitable opportunities in the production or generation, transmission, and retailing of clean energy technologies, business models, and applications.

Figure 1: Energy innovation and entrepreneurial dynamics that overlap to highlight clean energy entrepreneurship opportunities.

Energy entrepreneurs, therefore, play within an ecosystem of established companies and start-ups, academic and government institutions, financiers and grant-making institutions. Government initiatives, like Mission Innovation, and private sector financing, like the Breakthrough Energy Coalition, aim to financially support new energy entrepreneurs and innovative technologies and business models. Accelerators and incubators, like InnoEnergy in Europe, Elemental Excellerator in the USA, and Energy Lab in Australia, aim to provide hubs for entrepreneurs to develop and further commercialise their ideas. Large existing energy companies develop open innovation platforms, like Free Electrons, to bring startup companies together with utility innovators to scale up and deploy new technologies. Yet recent global analysis, our research on the inner workings of emerging incubators and accelerators, highlight that these ecosystems are still embryonic, with significant challenges for their optimisation, connection, and effectiveness (see World Economic Forum, Accelerating Sustainable Energy Innovation; Bumpus and Pascoe, in review; Bumpus and Neville, in review).

"Innovation lies at the core of any solution to the challenges facing our world today. Whether it’s the creation of new technologies that can help us stretch the limits of what is possible, or the development of new business models that make our world more efficient and interconnected, it is our business imperative as leaders to continuously reinvent, rethink, and reimagine." – Tim Ryan, US Chairman and Partner PWC (GII, 2018)

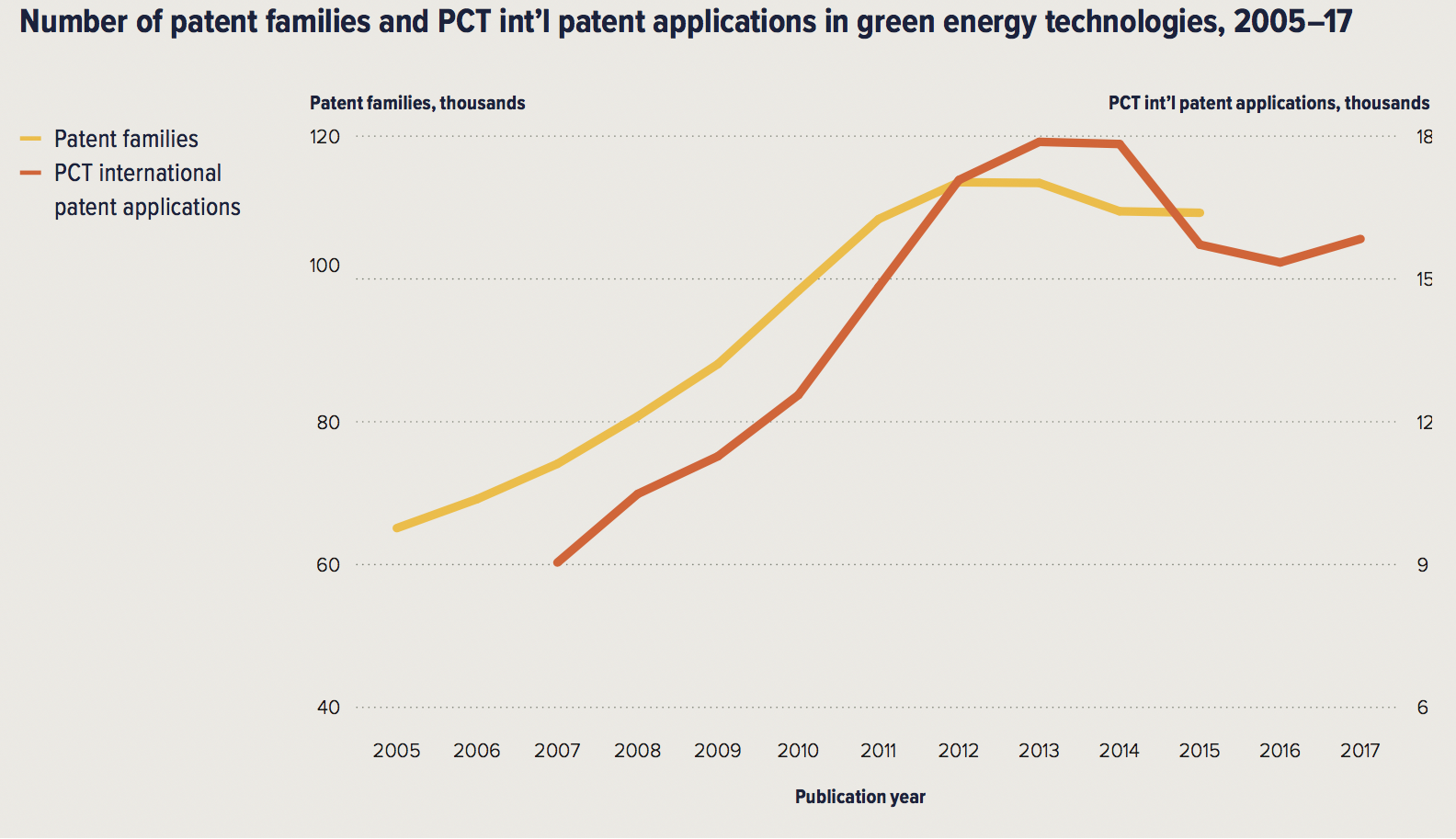

Supporting the move toward increased entrepreneurial activity, the number of international patent applications for green energy technologies lags behind trends in general technologies, and is more volatile (as would be expected from a smaller subset of categories) (see fig 2a).

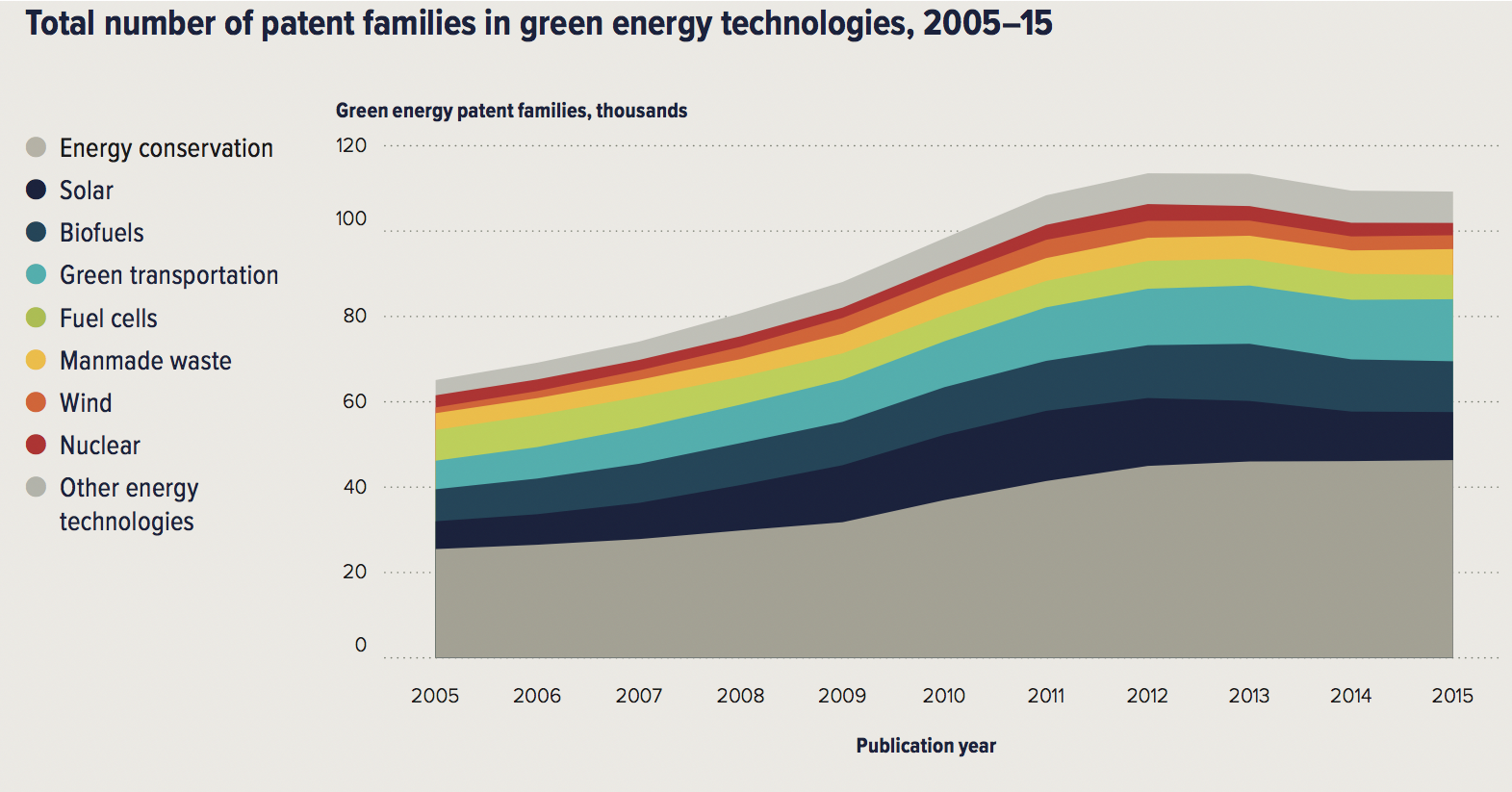

Figure 2a & 2b: a) Innovation patent applications for patent families (general in yellow) and for green energy technologies (specific in orange); and b) total number of patent families per specific green energy technology. (Source: Global Innovation Index 2018).

However, what is really interesting is the relatively steady proportions of investment in specific types of clean energy innovations that patent numbers record compared to the growth in ‘other’ technologies (Fig 2b). Within this bracket, new business models are emerging as a result of software and IoT technologies that are being adapted and used in new ways. It is the emergence of digital energy that energy entrepreneurs are focusing on.

Digital Energy Entrepreneurship

What are the challenges with clean energy entrepreneurship?

Critical to entrepreneurship is how services are discovered, evaluated, and exploited; the sources of opportunities; the processes of discovery, evaluation, and exploitation of opportunities; and the set of individuals who discover, evaluate, and exploit them (Shane and Venkatamaran, 2000). As such the ecosystems that support this discovery and commercialisation are critical foundations of entrepreneurial success: according to Isenberg (2010), it is not due to the heroics of one person or even one idea but the collective vision of a group of stakeholders committed to the promotion of entrepreneurship, creating an ecosystem to actualize their vision.

The WEF white paper Accelerating Sustainable Energy Innovation, noted that six principle ideas need to be addressed to assist in the global clean energy transition:

1. Establish an independent international sustainable energy innovation accelerator fund to finance innovative energy technology projects, blending public and private sources of capital

2. Develop instruments for public-private co-investment at the national or regional level to support and finance deep-tech energy innovations, reduce risks and improve the effectiveness of available public and private funding; if properly designed, such instruments would not only stimulate more private money into breakthrough energy projects but also would significantly improve the success rate and impact of public R&D grants

3. Mainstreaming energy innovation through strategic public procurement to use the power of public procurement to accelerate development and commercialization by providing first markets for innovative energy technologies and solutions

4. Create strong national institutions for energy innovation acting as a single voice for public support in energy innovation, bundling responsibilities as the main public funding authority, overlooking and steering the overall sustainable energy innovation process

5. Co-define energy technology roadmaps through public-private collaboration to align global policy and industrial innovation efforts and create a credible road to scale for technology areas of high potential currently advancing slowly

6. Super-transparency of government RD&D spending to improve the efficiency of the public R&D funding process and increase the transparency of opportunities and volume of public funding available for entrepreneurs and investors

Within the broader innovation ecosystem, entrepreneurs often bear great risk in bringing innovation to market through startups. This high level of risk for entrepreneurs is accepted because of the potentially high rewards for building a successful business. They work hand-in-hand with private and institutional investors to raise capital or ‘bootstrap’ through client and customer contracts to fund progress. This is especially hard in clean energy given the complexities of the sector and difficulty for commercialisation; as the boom and bust of clean energy technologies in the first 15 years of the 21st century showed.

Consider the principal components of the entrepreneurial challenge required for the decarbonisation goal peak emissions in 2020, and net zero by 2050: new business models and technologies, significant risk-tolerant capital deployed both widely and deeply, socio-cultural conditions to enable and incentivise individual behavioural change, and a broad based ecosystem to support systemic change. These components pose both high castle walls to climb, but significant riches for entrepreneurs that can successfully scale them.

Within broader innovation dynamics, new energy technologies face specific challenges to adoption. Five key messages emerged from the Global Innovation Index survey (2018):

1. Innovation has a key role in meeting increasing global energy demand

2. Energy innovations are happening globally, while objectives differ across countries

3. New energy innovation systems need to emerge, with efforts along all stages, including energy distribution and storage

4. Obstacles to the adoption and diffusion of energy innovations remain numerous

5. Public policy plays a central role in driving the energy transition

The GII highlights that for energy innovations to reach their full potential new energy innovation systems, coupled with intense innovation efforts, are needed at all stages of the energy system value chain. Higher levels of technological and non-technological innovation are required on supply side, including cleaner energy sources, but also critically on the demand side, including smart cities, homes and buildings, energy efficient industries, and transport and future mobility, and enabling technologies for the optimization of energy systems, including smart grids and advanced storage technologies.

The role of Digital Energy

Technology trends are an important indicator and determinant of how entrepreneurial ecosystems are developing, and how socio technical transitions, for example in clean energy, come to pass. Entrepreneurs in clean energy have in turn evolved alongside other industries developing hardware solutions, from generating clean energy to storage to mobility; and alongside software industries, including evolving from software to enable renewable generation, through to blockchain-enabled clean transactive grids.

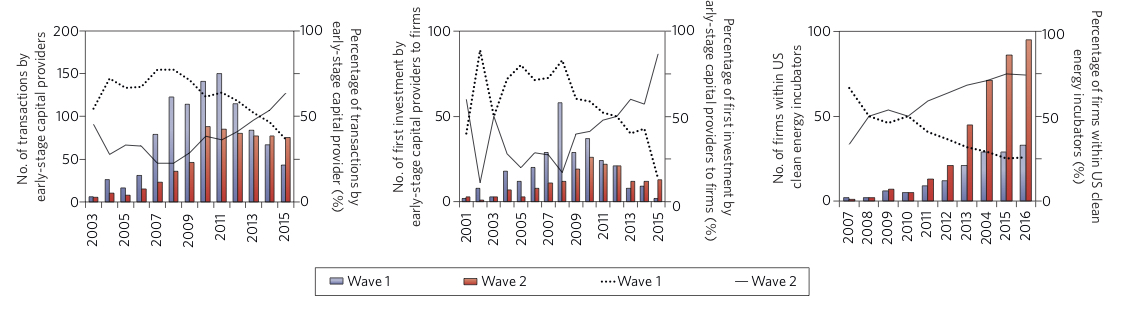

Bumpus and Comello (2017) noted an increasing development of global early stage investments for software led companies over the last fifteen years, increasing first investments by early stage capital providers, and increasing prevalence in US-based technology business incubators.

Figure 3: Early stage support for energy startups in Wave 1 (hardware and generation technologies) and wave 2 (software, optimisation, efficiency technologies). (Bumpus and Comello, 2017).

The role of wave 2, digital clean energy innovation should not be underestimated in the goal of decarbonisation: it provides an opportunity for capital-light experimentation, optimisation and increased efficiency of existing clean energy generation assets, and an opportunity for entrepreneurs suited to software technology development to apply learnings from successful digital innovation into the clean energy issue.

Figure 4: Entrepreneurship, clean energy, and digital innovation confluence.

Importantly, digital energy provides significant ‘stick and a carrot’ incentives for clean energy entrepreneurship and innovation. Technologies and business models that have high uncertainty and high impact are fruitful places for entrepreneurs to seek profit opportunities. Firstly, digital energy encompasses the critical elements that energy managers and executives worry about most: the rise and disruptive capability of digital tech in blockchain, IoT, AR/VR, and AI/ML. Secondly, it can be applied in myriad ways to existing clean energy generation and hardware systems to help optimise, creating economic and environmental value faster from idea conception to pilot and product roll out. Thirdly, digital innovations make money. The profit incentive, and material liquidity events that have been seen in the non-energy digital landscape, mean that digital innovation for clean energy entrepreneurs holds strong incentives for high risk time and sweat equity investment. E.g. Aus report on digital.

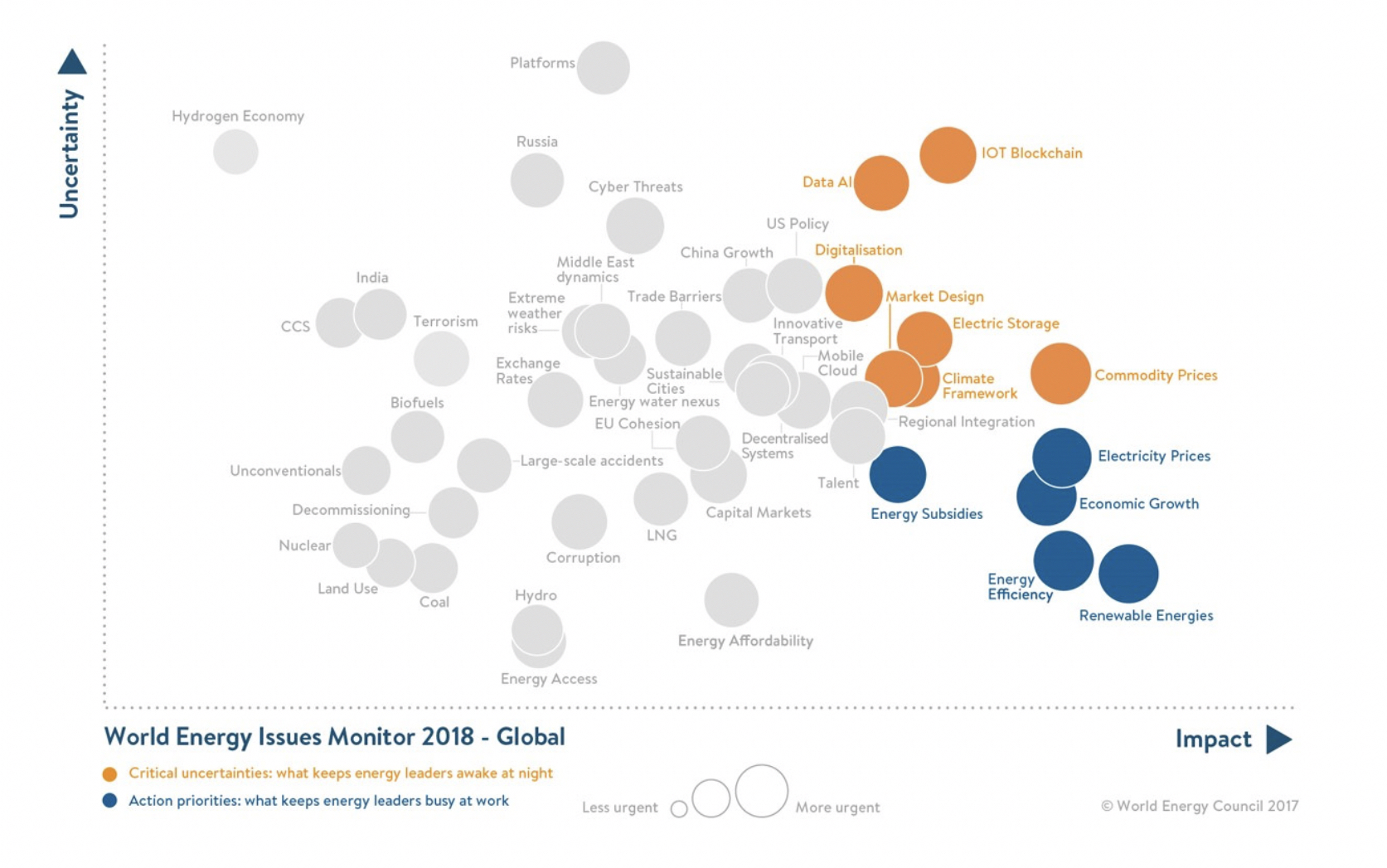

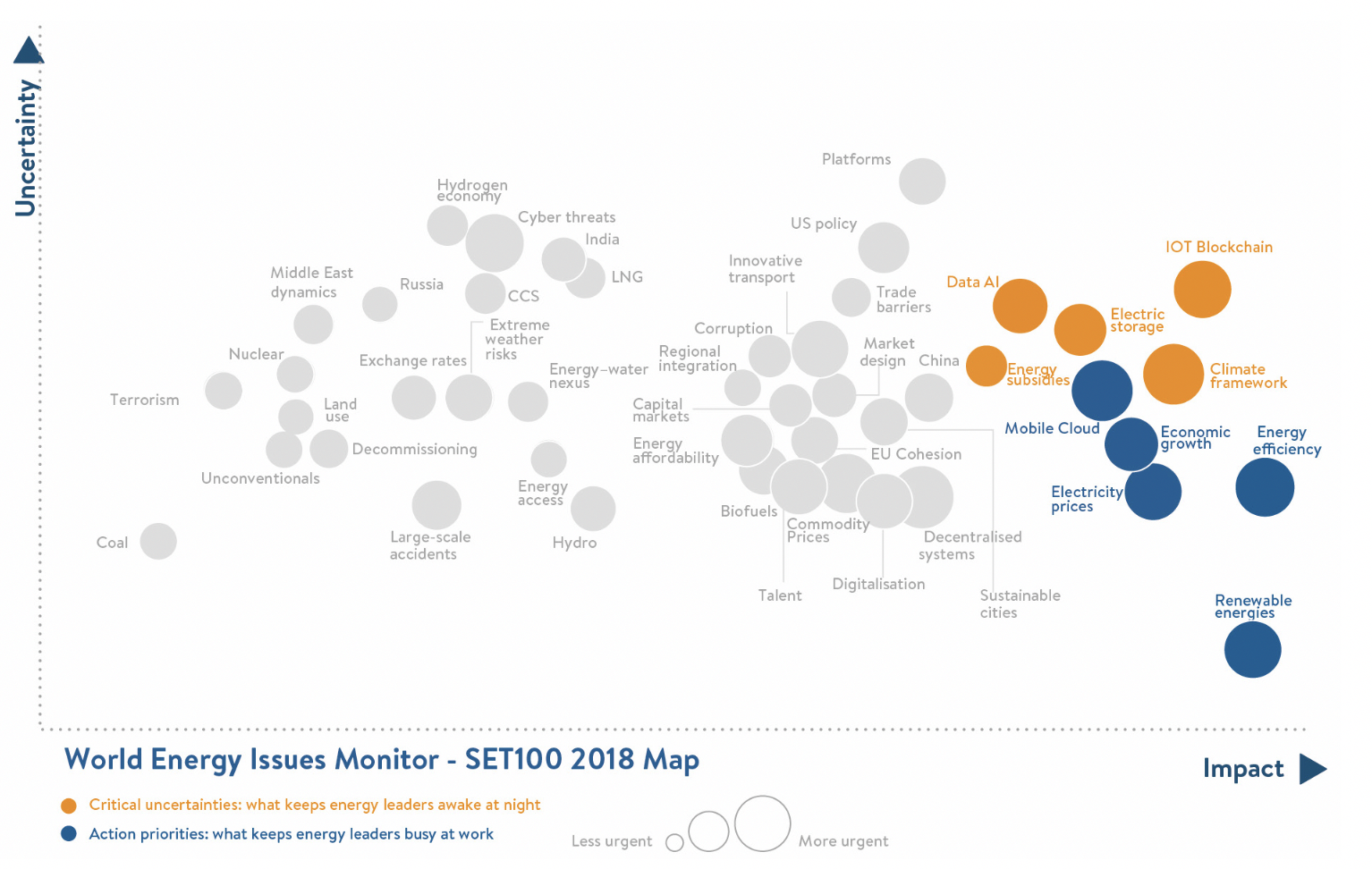

The focus on this sector from both incumbent and entrepreneurial point of view is summed up in the World Energy Council Issues Monitor 2018. In the WEC report, blockchain appears with the same level of high impact and high uncertainty in both SET100 and Global Perspective Maps. This suggests that the increasing pace of innovation is difficult for both start-ups and Energy Leaders to understand. Data and AI, energy efficiency, renewable energy in general, storage, and finally the climate framework all were common concerns (with digitalisation added in for incumbent energy leaders as a catch all issue).

Figure 5: What keeps energy leaders awake at night as voted by national energy leaders (incumbents).

Figure 6: What keeps energy leaders awake at night as voted by the Sustainable Energy Transition Awards (SET100) community (startups).

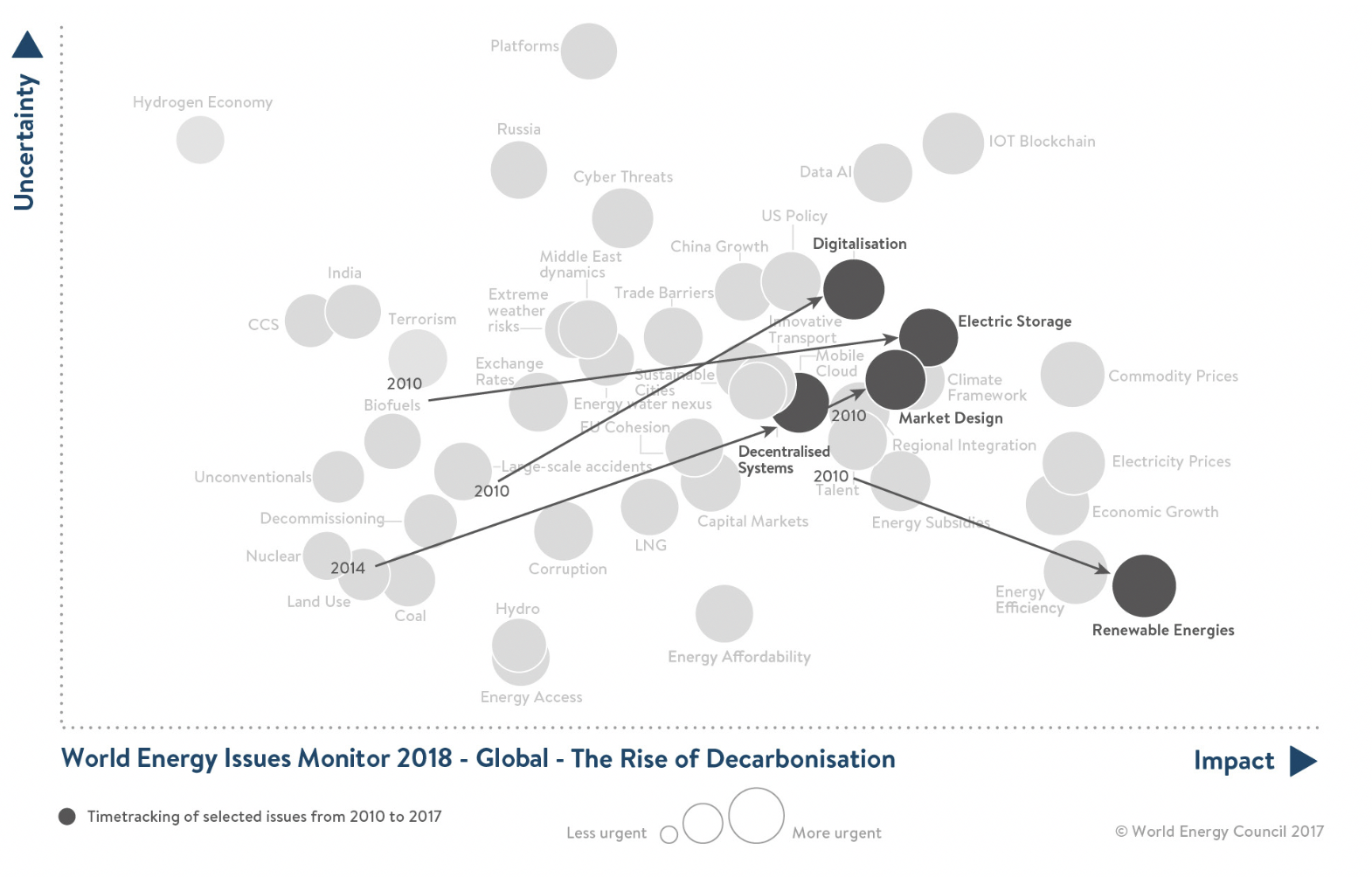

The trends highlighted by Bumpus and Comello (2017) and in the WEC report note the importance of considering decarbonisation, and the compounding role of digital energy, and the importance of the high uncertainty opportunity for entrepreneurs.

Figure 7: The rise of decarbonisation on the energy agenda, and concomitant uncertainty in digitalisation technologies.

Interestingly, when we consider the context of digital energy within the broader energy innovation landscape, we see an even more complex, but compelling, landscape. For broader ‘green energy technologies’, there has been a decline in patent applications in energy innovation since the peak in 2012 (GII, 2018; see Figure 2). Combined with the data from Bumpus and Comello (2017), this trend may relate to the shift toward Wave 2 technologies that rely less on hardware patent applications and more on new, innovative business models or software applications that enable existing hardware technologies but that are not patentable (cf Wainstein and Bumpus, 2016).

To refine even further, we can through this approach see the opportunities and threats that are posed by IoT Blockchain and Artificial intelligence. In addition, recent work with the Free Electrons international accelerator has shown that these categories are gaining traction with both incumbents and startups as opportunities for the evolution toward net zero carbon by 2050.

Focus of the Briefing

Given these macro trends, and the rise in entrepreneurship in general, the focus of this briefing is on the role of digital energy entrepreneurship, and how these new companies are being supported in the Australian and German ecosystems. These companies pose threats and opportunities to the incumbent energy system, and as shown above, are clearly on the upward trend for industry concern and action.

Firstly, then, we focus on entrepreneurs associated with Digital Energy technologies and business models. Most hardware solutions obviously also include some digital assets (i.e. software), however digital energy is more focused on software being the principal driver of value in the enterprise. In particular, and given the concern and opportunity identified in global surveys of clean energy innovation, we focus here on the role of companies using blockchain and artificial intelligence.

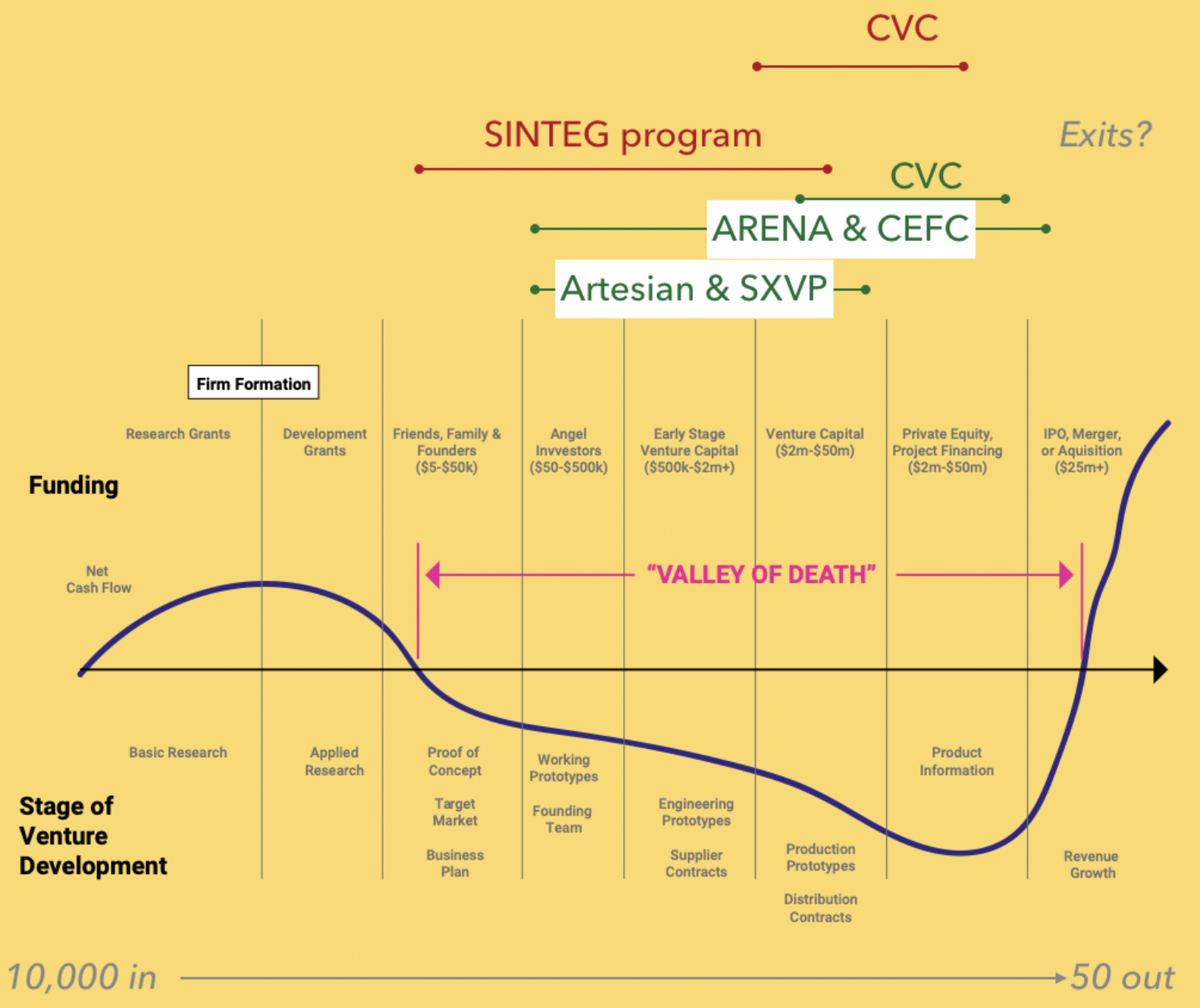

Secondly, the role of capital in enabling clean energy entrepreneurship is important in understanding how new ideas are commercialised and sustained in the market. Early stage capital, that is normally relatively risk tolerant, has been traditionally difficult for sectors like cleantech which has seen large boom and bust periods in the mid-late 2000s. Some have suggested that venture capital is simply not right for cleantech at all (Gaddy et al. 2017), while others have suggested that venture capital plays an important role in placing many early stage bets (REF). Government funding for early stage cleantech is also an important component for supporting entrepreneurs, with startups securing government grants using them as an important avenue to early stage private capital (Islam et al 2018). Others note that given the difficulty in navigating the deep valleys of death for clean energy entrepreneurs, multiple stage capital sources need to be intermediated and aligned (Bumpus and Comello, 2016; Monk et al 2015).

Thirdly, technology development, capital provision, infrastructure and market access, and cultural conditions are enabled and brought together in how entrepreneurial ecosystems are supported. Social and cultural conditions enable entrepreneurialism when they support partnerships and coopetition (cooperation within and between competitive entities), levelling of the playing field or tilting it to the entrepreneurs, and broader understanding and acknowledgement in the public and senior decision makers (public and private sector) of the importance of both the topic (clean energy) and the mechanism (entrepreneurship).

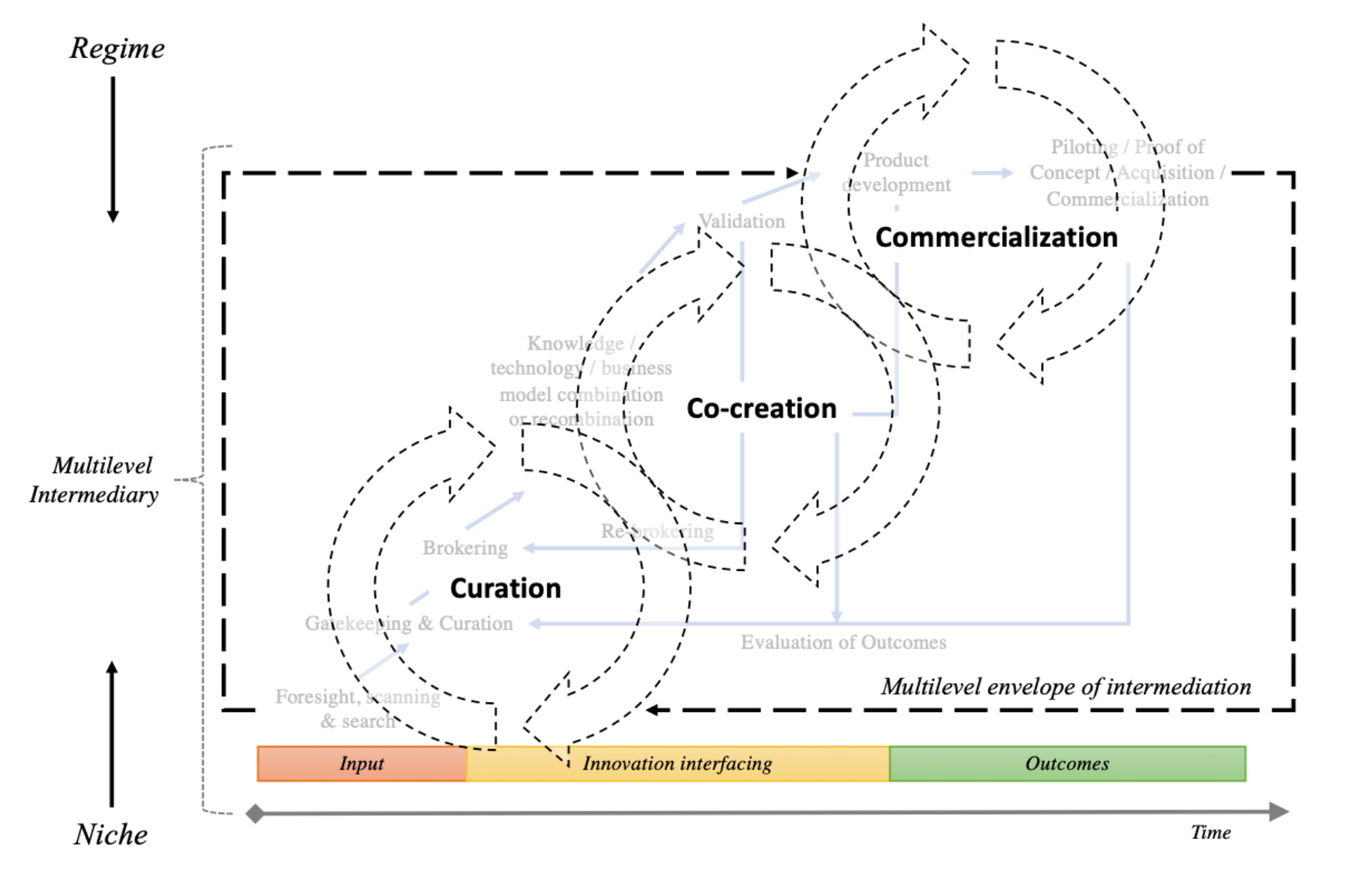

The ecosystem, therefore, provides the petri dish in which entrepreneurial activities occur. They enable interactions between entrepreneurs, capital providers, government support, customers, incumbents, and importantly, markets. Innovation ecosystems have been shown to be important determinants in regional entrepreneurial success. Networked incubators and accelerators are increasingly important components of clean energy ecosystems as conduits of flows for capital, knowledge, and social networks (forthcoming: Bumpus and Pascoe, 2018). Understanding the focus, maturity, and effectiveness of entrepreneurial ecosystems enables a better understanding of how new innovations are brought to bear in the market. Much of these opportunities can be seen through Open Innovation platforms that enable interactions between entrepreneurs and the market: i.e. through hackathons, incumbent-entrant innovation forums, inward and outward entrepreneurial investment platforms and support mechanisms (AusTrade etc.).

In the context of policy, this briefing focuses primarily on national policy, but makes reference to state policy where relevant.

Where do Australia and Germany sit for innovation?

Climate response, innovation and economic development are tightly intertwined. A recent OECD report outlines that countries that harness innovation and entrepreneurship as engines for new sources of growth will be more likely to pull out of, and stay out of, recession, and reach their climate goals. Australia and Germany pose distinctly different, but complementary economies for clean energy entrepreneurs. Australia with abundant renewable energy resources associated with electrification of residential, commercial, and even heavy industrial opportunities (Beyond Zero Emissions Electrifying Industry Report, 2018); deregulated electricity retail markets; and the highest penetration of rooftop solar in the world. Germany with a progressive regulatory environment, strong renewable feed in tariffs, vibrant community energy cooperatives, and successful roll out of renewable energy. Both countries have strong incumbent electricity companies that are taking smaller or larger steps toward decarbonization, and both countries have thriving startup scenes.

Table 1: Germany and Australia comparative statistics (Raw data sourced from CountryEconomy, 2018).

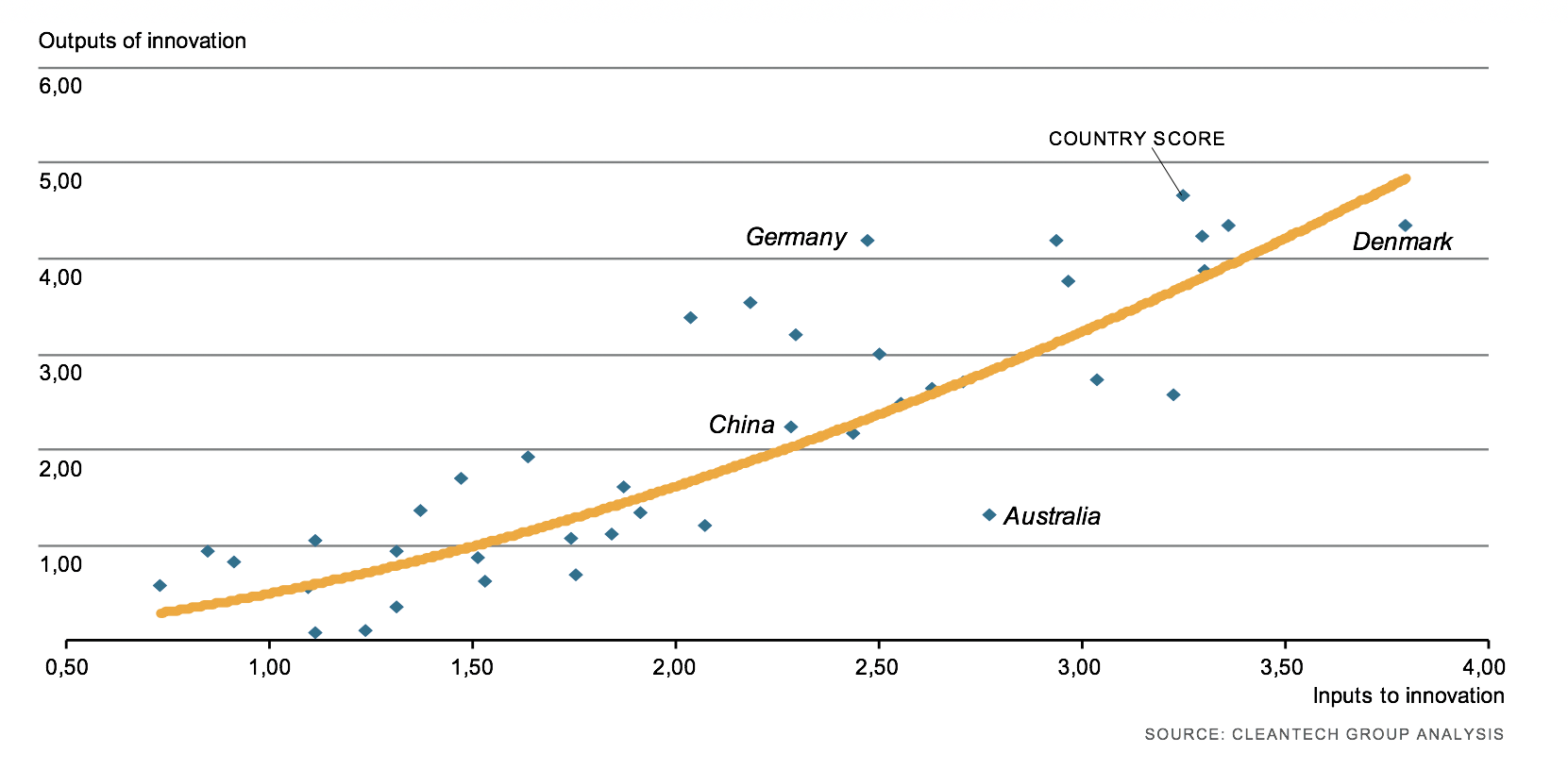

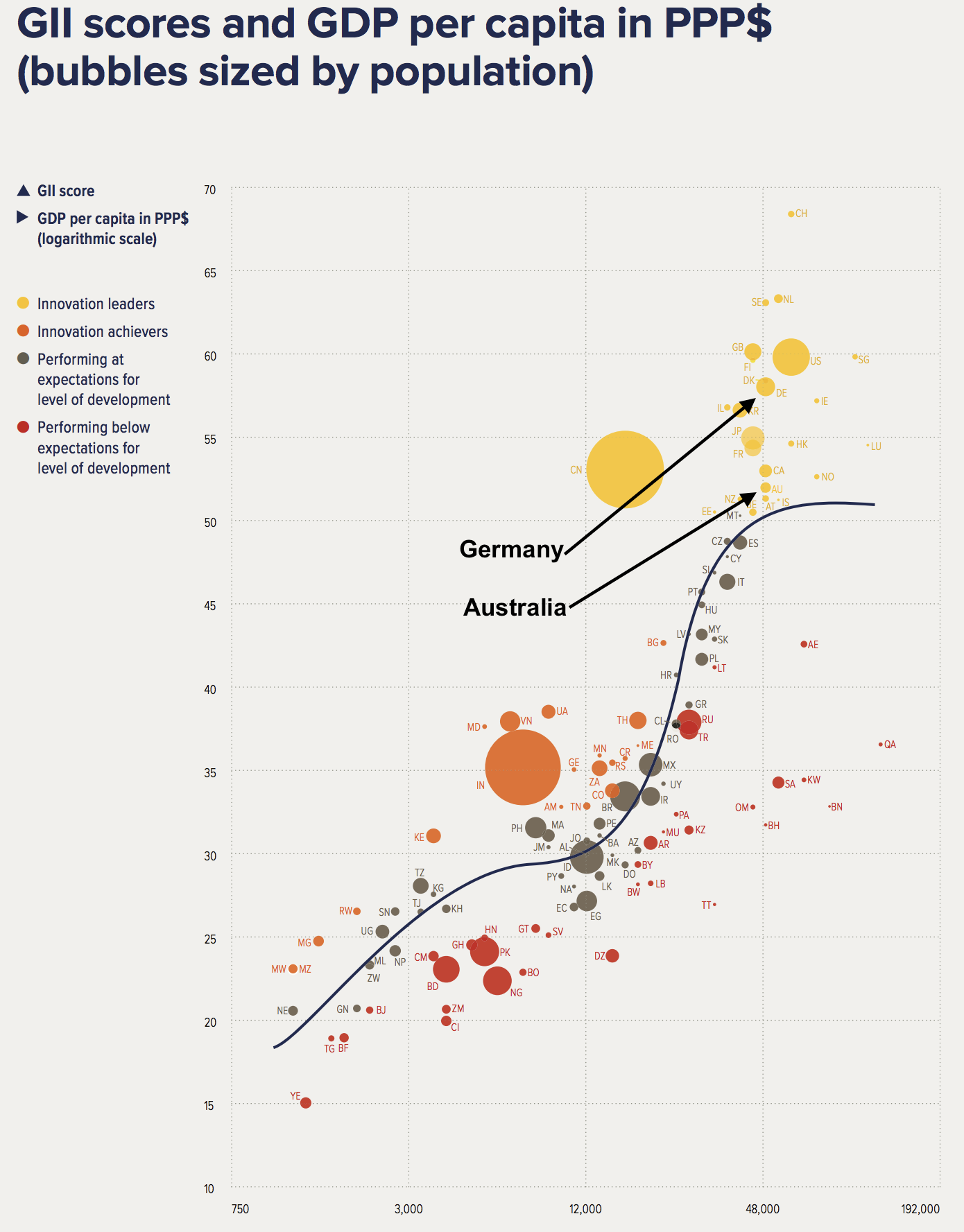

The top 5 high-income economies in the quality of innovation in 2018 are Japan, Switzerland, the U.S., Germany, and the United Kingdom (U.K.) (GII, 2018). When comparing Australia and Germany for their innovation index, we see that both are advanced innovation economies, but with Australia lagging behind in terms of outputs and impact (see Fig. 3 and 4).

Figure 8: Cleantech innovation efficiency according to inputs to and outputs of innovation (Cleantech Group Analysis, WWF 2017).

Supporting the cleantech innovation index from WWF in 2017, the GII (2018) also notes that Germany overperforms on innovation outputs as related to its inputs, and Australia underperforms on the same metrics.

Figure 9: Comparison of Australia and Germany for innovation according to GDP per capita (GII, 2018).

Context - Australia

Internationally, Australia is a signatory to the Paris Climate Agreement, and a member of Mission Innovation, which seeks to drive decarbonization through an innovation agenda. Nationally, federal agencies such as ARENA and the Clean Energy Finance Corporation are financing clean energy innovation and entrepreneurial activities at different levels, and are complemented by state level support for clean energy innovation. In addition, digital innovation is seen as a key driver for Australia’s economic growth, adding a potential $315bn to the economy, noting that, “the world is entering a new phase of economic development as every sector of the economy is re-defined as a result of digital science and technology and the extensive use of data.” (CSIRO 2018).

Australian climate and energy policy has a tempestuous history. It has, at times, helped spur distributed household and utility-scale renewable energy development by setting targets, identifying organisations to take action, and creating support mechanisms for deployment. More recently, the Coalition’s National Energy Guarantee (NEG) set a target of 36% renewable energy generation in the gridm whilst Labor’s aspirational target was 50 per cent by 2030. However, now in the absence of clear policy following the collapse of the NEG policy, there is no post 2020 renewable energy target. Instead, Australian states will take on targets for renewables: Victoria, for example has a renewable energy generation target of 25% by 2020 and 40% by 2025, while Queensland’s target is 50% renewable energy by 2030.

Despite the total lack of policy certainty, Australia’s renewable energy resources have opened up significant opportunities for distributed energy resources (DERs) and opportunities to use renewable energy in heavy industrial processes including becoming the first country to produce emissions-free steel without coal, exporting renewable ammonia – a zerocarbon fuel, and zero-carbon production of energy intensive materials such as carbon fibre (Beyond Zero Emissions, 2018). Optimisation of the current grid is also emerging as a critical entrepreneurial opportunity.

The Australian clean energy entrepreneurial ecosystem has been developing over a number of years as private sector actors responded to state and federal government tariffs and support for wind and solar farm development, rooftop solar delivery, and commercialisation of deep technology from universities. A wider, more actively incubated startup ecosystem for energy entrepreneurs has subsequently gained traction since 2015/2016. In comparison to a few, rather siloed, deep technology points of focus (e.g. wind, rooftop solar, R&D for energy materials commercialisation), the broader ecosystem took on the form of a shallow, but wide lake: many different ideas but without investable substance (Acceleratenergy, 2016; ).

Key conclusions from the report were that incubators and accelerators are playing a vital linking role in the huge opportunity space for clean energy entrepreneurship in Australia; that building effective technology and commercial teams with guidance from elders is critical; and that investor resources and funding models need to be better developed. Finally, the report concluded communicating and celebrating the success stories of clean energy entrepreneurs is lacking but is needed to build and engage a vibrant clean energy start-up community.

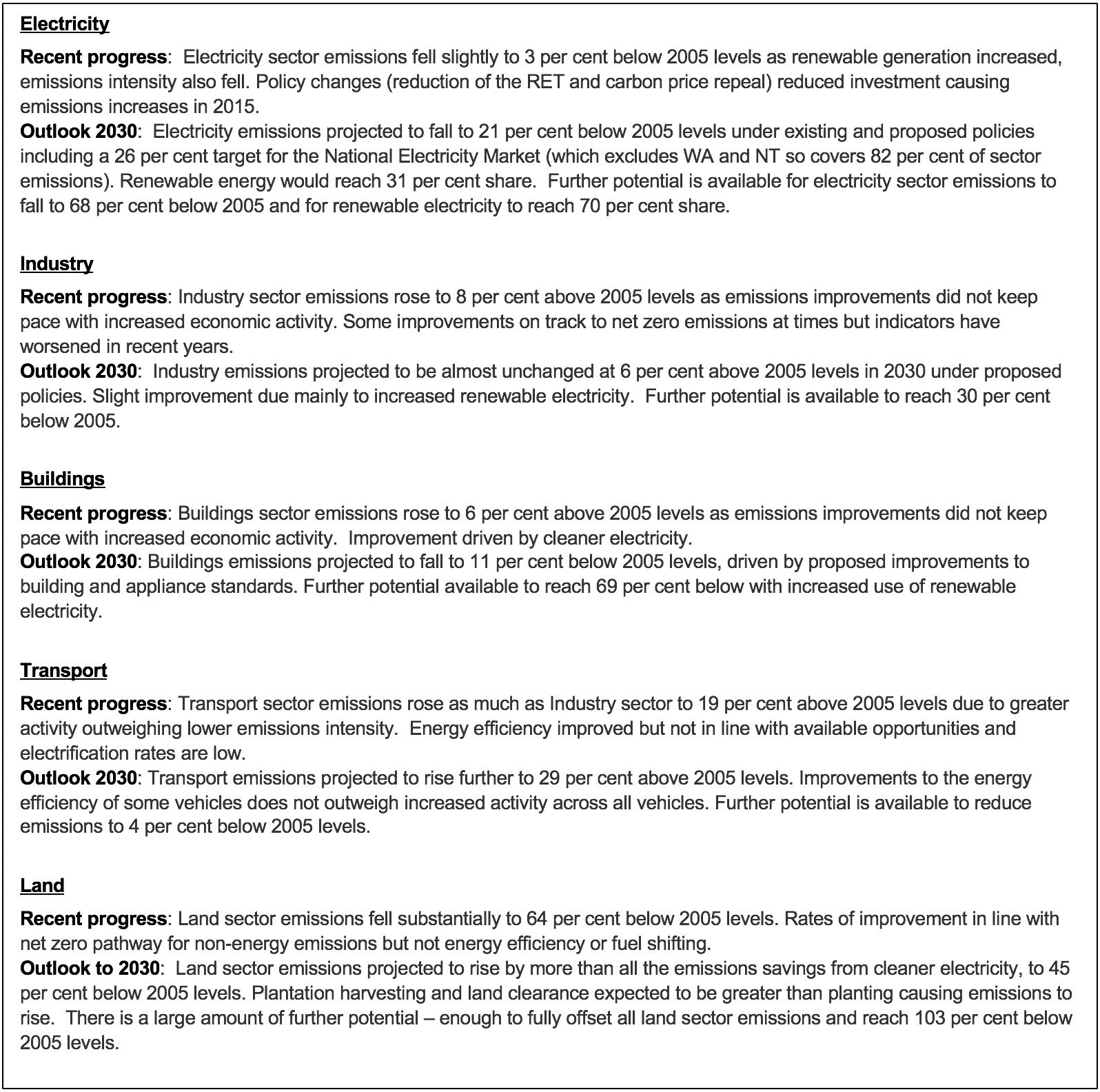

Box 1: Highlights for Australian Decabonisation 2018 - 2030, and Net Zero by 2050 (ClimateWorks, 2018)

ARENA and the CEFC continue to make investments in clean energy innovation across the clean energy innovation landscape. However, the University of Melbourne and Stanford University report, Acceleratenergy (2016) highlighted that clean energy entrepreneurial ecosystem in Australia faces two compounding, fundamental challenges:

1. The new digital energy entrepreneurs and the industry is new, with high uncertainty as to how it will evolve

2. New enterprises attempting to access, and thrive in, this emerging industry face technological, business model, economic and policy barriers that continually threaten to leave them in the ‘valley of death’

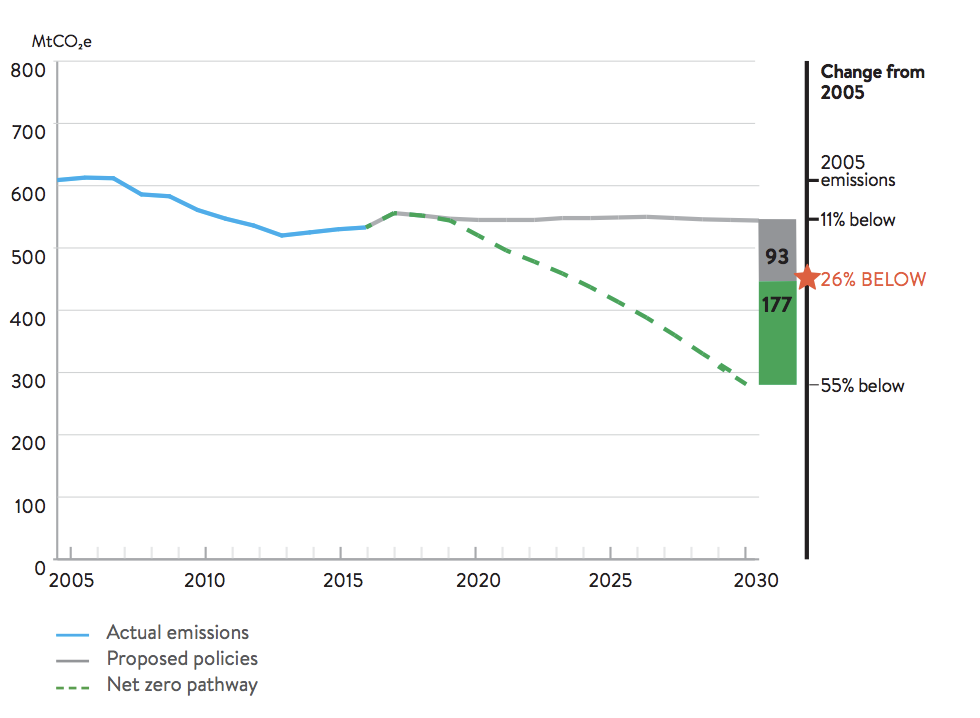

A number of studies have highlighted the different pathways to decarbonisation in Australia; many of which relate to entrepreneurial opportunities to enable new products and business models to enter the market. Climateworks Australia (2018), note that Australia is not yet on track to meet its Paris commitments, and net zero emissions by 2050. Australia needs to double its emissions reduction progress to achieve the federal government’s target of 26-28 per cent below 2005 levels by 2030, and triple progress to reach net zero emissions by 2050. The report shows that progress has stalled in most sectors and reversed overall.

Industry, buildings and transport sectors are increasing in emissions, but significant entrepreneurial opportunities exist. For example, the electricity sector is reducing emissions and emissions intensity with electricity emissions projected to fall to 21% below 2005 levels under existing and proposed policies with renewable energy reaching 31% share. Further potential is available for electricity sector emissions to fall to 68 per cent below 2005 and for renewable electricity to reach 70 per cent share. Increased clean energy generation and efficiency would also positively impact the industrial and buildings sector, which need to be supported by improved sector-specific regulation and technologies for industry, and proposed improvements to building and appliance standards for buildings. Transport emissions have risen to 19% above 2005 levels due to activity outpacing emissions reductions, but could be reduced with improvements in low emissions fuel standards and a more rapid switch to electric vehicles.

Figure 10: Total emissions since 2005, projected emissions to 2030 under proposed policies scenario and the net zero pathway and gap to target (ClimateWorks Australia, 2018).

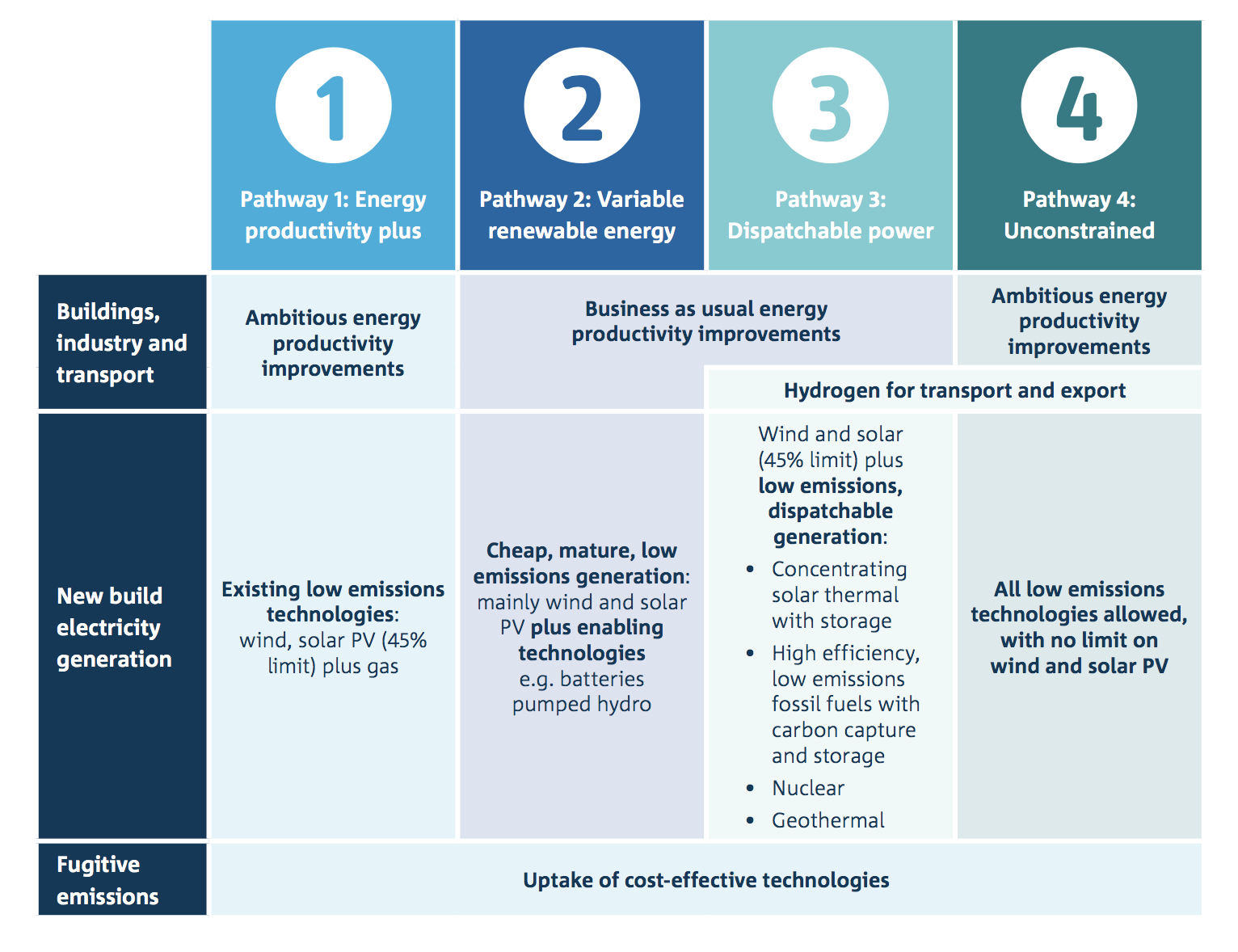

The good news is that several studies notes that the power sector will be at the heart of Australia’s energy system transformation (IEA, 2018; CSIRO, 2017). CSIRO’s (2017) report highlighted four low emissions pathways that enable new technology development (see Fig 11). And that this can support broader economic emissions reductions through abundant clean electricity is improved industrial, commercial, residential, and transport technologies take advantage of the cleaner grid.

Figure 11: Pathways for decarbonisation in the Australian economy (CSIRO, 2017).

For entrepreneurs, these high emissions sectors, and the baseline opportunity from clean grid electricity, and the relatively deregulated nature of energy generation and retailing, poses great opportunity to develop new technologies and business models to seek profit in decarbonisation.

Context - Germany

Germany’s Energiewende (energy transition) is well underway. The Energiewende dates back over three decades and has evolved from grassroots environmental activism to a politically-steered process. Several changes in the political and social power constellations, as well as endogenous policy measures and exogenous events, have shaped the processes (Kuttinen and Velte, 2018)

Similarly, Germany’s digital revolution is also taking place, guided in large part by government direction from the BMWi. BMWi’s digital strategy explicitly includes systematic use of the digitalization potential in the fields of energy, transport, health, education, and public administration. This is encapsulated in the Smart Networking Strategy was adopted by the cabinet in September 2016:

“Products and services increasingly contain digital value added and are getting “smart” by incorporation into intelligent and networked systems.New business models are arising in the digital environment. Completely new ecosystems with value added chains are being created in which data are an important resource. The use of digital (data) technologies gives rise to new areas of knowledge and industry: we are now seeing data-supported health services (e-health), using data-driven financial services (Fin-Techs) and have the first applications of intelligently networked energy production and supply (smart home).” - (BMWi, 2017, p15)

Germany is well equipped to make this transformation given the country’s starting position as an established innovation and production location. Germany has already made its mark on the development. “Industry 4.0” has long become an internationally accepted term to describe the current challenge: the networking of people, machines, plant and processes to form an intelligent whole. BMWi estimates that digitalising industry will open up potential additional cumulative added value of €425 billion until 2025 in Germany alone. Projections put productivity gains at up to 30 %, annual efficiency gains at 3.3 % and cost reductions at 2.6 % annually (BMWi, 2017).

Germany’s digitalisation opportunities build on its deep technological and engineering history, and its strong guidance, policy support, and economic incentives from government for the installation of renewable energy across the country. Germany has been considered to be “the world’s first major renewable energy economy" (Renewable Energy World, 2009).

Until 2014 it had the highest capacity of solar installation of any country in the world, until overtaken by China and the US. the Renewable Energy Sources Act enabled the share of renewables in electricity consumption has steadily grown over the last few years – from around 6% in 2000 to around 36% in 2017. By 2025, 40-45% of electricity consumed in Germany is to come from renewables (BMWi, 2018). Wind and solar are the biggest contributors, followed by biomass. In 2017, solar PV installations, for example, generated 43 gigawatts of electricity, and in the first half of 2018, renewables provided for 41% of the country’s energy needs (https://www.energy-charts.de/index.htm).

The electricity grid in Germany is also becoming smarter with the advent of the SMARD grid system, enabling improved visualisation of the energy mix across the German grid (SMARD). This improvement of visualisation of the grid enables entrepreneurs to explore market opportunities on the intersection between variable grid prices, baseload configurations, and interconnectedness with other jurisdictions. The Energy Transitions Hub ‘OpenNem’ project is enabling a similar view in Australia.

What is the digital energy technology focus?

The digital energy technology context in Australia

“the power, control and responsibility for generating and managing energy is fast moving into the hands of the consumer." - Jemma Parsons, AFR April 10, 2017

Digital innovation is an emerging and strong hallmark of clean energy entrepreneurs in Australia. Digital technologies could help boost energy management and efficiency in Australia including better pre-emptive demand response management.

However, Australia seems to be missing the digital energy innovation boat. Digital innovation could deliver $315 billion in gross economic value to Australia over the next decade (CSIRO, 2018), but use cases for digital energy innovation still remain on the periphery.

Where there are new technology trends, they are focusing on improving customer experience and optimising existing decentralised energy resources (DERs). Disruptive start-ups achieve this by picking off a piece of the incumbent's business model and redesigning it in a way that highly customer-centric. They give customers more of what they want and less of what they don't. They deliver it in a way that is fast, digital and pain-free. And gradually they take market share away from incumbents (AFR 2017).

Digital energy (Wave 2) technology companies differ to traditional hardware (Wave 1) technologies which are more focused on generation of clean energy, and in some ways differ to the participants in the traditional support systems for hardware technology development. To date this has been undertaken through university commercialisation arms and industry support mechanisms like the Clean Energy Council, who have worked hard to support manufacturing and clean energy generation (e.g. rooftop solar) installations. Their categories for technology, for example, are: bioenergy, cogeneration and trigeneration, energy efficiency, energy storage, geothermal, Grid, hydroelectricity, large-scale solar PV, marine energy, and off-grid renewables. ‘Digital’ energy, has not factored significantly yet in these support mechanisms.

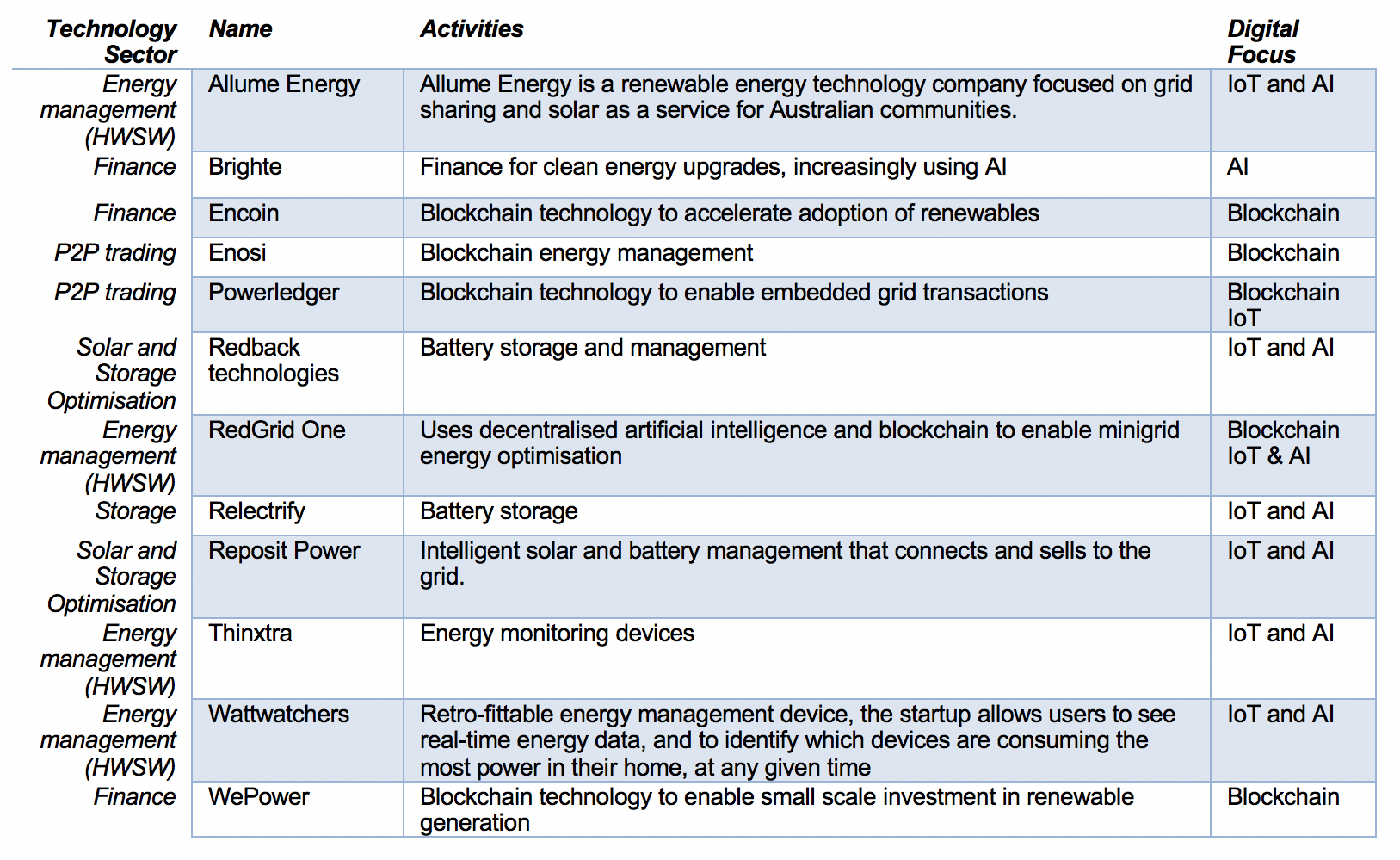

Instead, digital energy technologies incorporate technologies which are cross cutting, such as AI and blockchain (e.g. with the Fintech sector) and span not only energy, but other ‘cleantech’ technologies and themes (water, pollution, etc.).

In digital energy we can see this emerging in four principal areas:

- Consumer engagement through new business models running on web2.0; e.g. Powershop, DC Power Co.

- Internet of Things (IoT) hardware and software integration for behind the meter control and grid integration; e.g. Greensync, Zen Ecosystems, WattWatchers

- Enabling new transactive opportunities through blockchain and web 3.0; e.g. Powerledger, Enosi, RedGrid

- Artificial intelligence and machine learning that integrates the physics of the energy system with markets; e.g. Reposit Power; Relectrify

Table 2: Examples of digital energy startups in Australia (Source: Author analysis).

It is difficult to asses the total landscape and opportunity for startups in energy due to their diffuse profiles and difficulty of categorising startup/entrepreneurs, however of 100 ‘Startups to Watch in 2018’ only two focused specifically on energy (Powerledger and Wattblock).

What is clear to see, however, is that startups are moving into the digital energy space due to the opportunities that are brought about by the 3D-5Ds of the energy transition (decarbonisation, decentralisaton, and digitalisation, plus deregulation and democratisation). Similarly the ‘Four Horsemen of the Energy Utility Apocalypse’ (with thanks to Dr Stephen Comello of Stanford for this insightful categorisation) - the Internet of Things, Artificial Intelligence and Machine Learning, Cybersecurity, and Blockchain - are enabling software tech companies to move into the energy space.

This will only increase over time. By 2020, there are expected to be 200 billion IoT devices (up from only 15bn in 2015). And already Australian startups and scaleups, like WattWatchers, are enabling IoT for new clean energy opportunities. For 2020 onwards, what digital energy technology means for current retailers is that their business models will need to change. The most successful retailers will be those that understand their new role as both enablers of consumer-led electricity generation and management, and partners to customers who are now key players in the generation and trade of stored energy between homes, businesses, retailers and the grid (AFR, 2017).

The CSIRO's, (2017) analysis shows that by 2050, the 2017 cost projections for wind and rooftop PV are lower than were projected in 2015, indicating the costs are more rapidly decreasing than previously assumed. For rooftop solar PV, the recent cost estimate reductions have also improved the longer term outlook, together with CSIRO’s new assumption that learning for both the panel and balance of system can continue at faster rates for longer (CSIRO 2018, p. 11).

This has important implications for the development of digital energy optimisation technologies now that will enable panel integration and improved balance on the grid toward these cost savings in the future.

Beyond wave 1 (hardware-based RE generation technologies), and even wave 2 (software and hardware-software integration and grid optimisation technologies; cf. Bumpus and Comello, 2017), energy storage technologies, as well as clean energy export technologies, will play an increasingly important role from now until net zero, and beyond. The CSIRO Electricity Generation Technology Cost Projections Report (2017) noted that strong learnings can come from the transport sector given the faster uptake of storage technologies (i.e. in electric vehicles), making this sector the strongest source of learning and thus cost reductions). The updated projections indicate the trend we have seen in the last few years whereby solar photovoltaics, wind and battery storage technologies reduce their costs at a faster rate than most other technologies continues.

Between 2030 and 2050, energy entrepreneurs will need to continually evolve technologies in line with climate threats and modeling. To limit to 1.5°C, the sequencing involves rapidly decarbonising the grid, enabling all fossil based combustion to be converted to electricity (i.e. electrification), and then sequestration technologies to pull temperatures back down from +2°C to 1.5°C. This is in the context of projections that indicate that by 2040 the world will require up to 30% more energy than it needs today (GII, 2018).

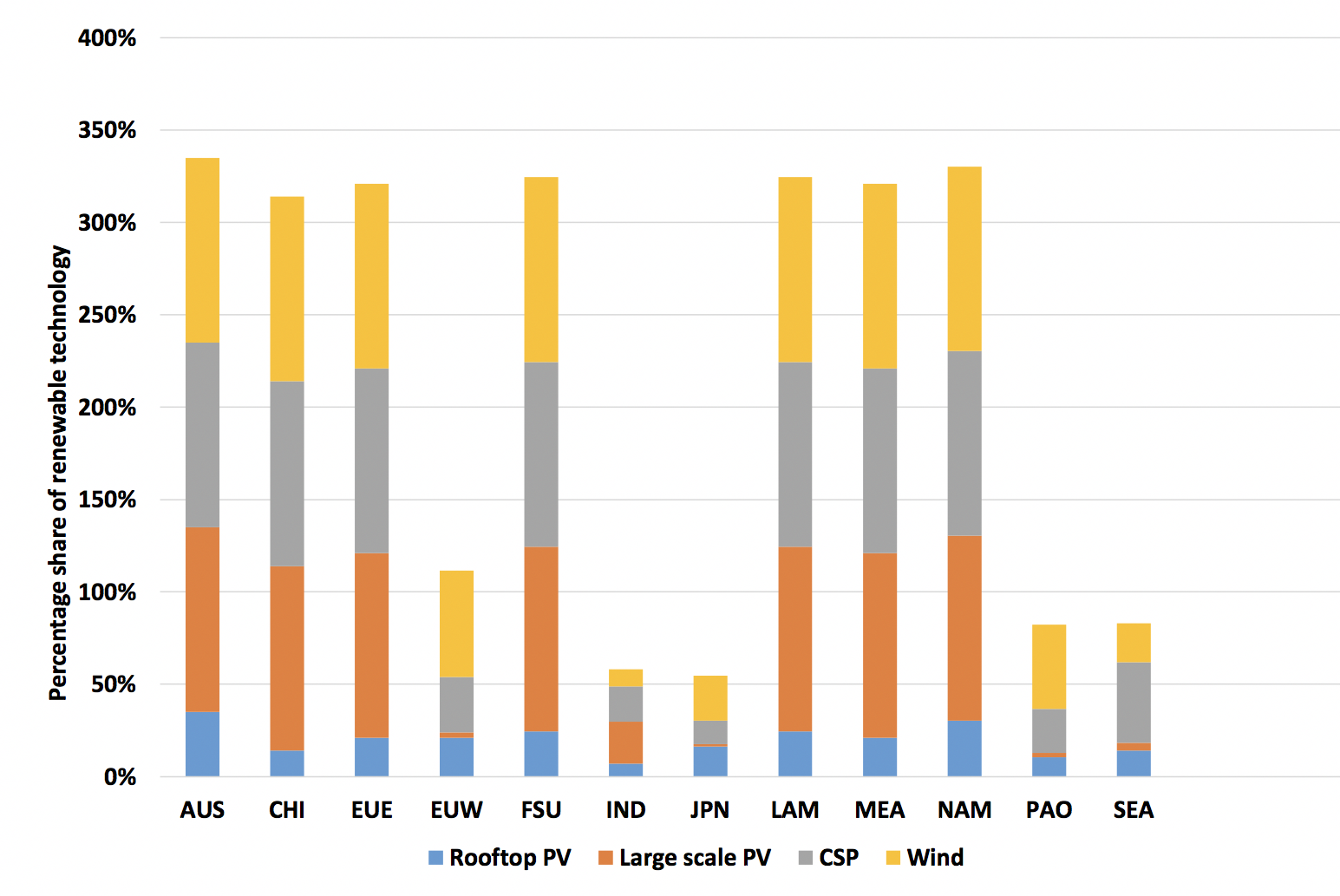

Figure 12: Percentage of demand that can be met by various renewable technologies in 2050 (CSIRO, 2017)

The CSIRO report notes that data on this topic will likely change over time, and that particular areas for future review are building integrated solar and offshore wind. New forms of solar panels, and their ability to be integrated into structures are potentially game changing. Free floating offshore wind technologies could open up a wider area of ocean resources if proven cost effective and robust (CSIRO, 2018).

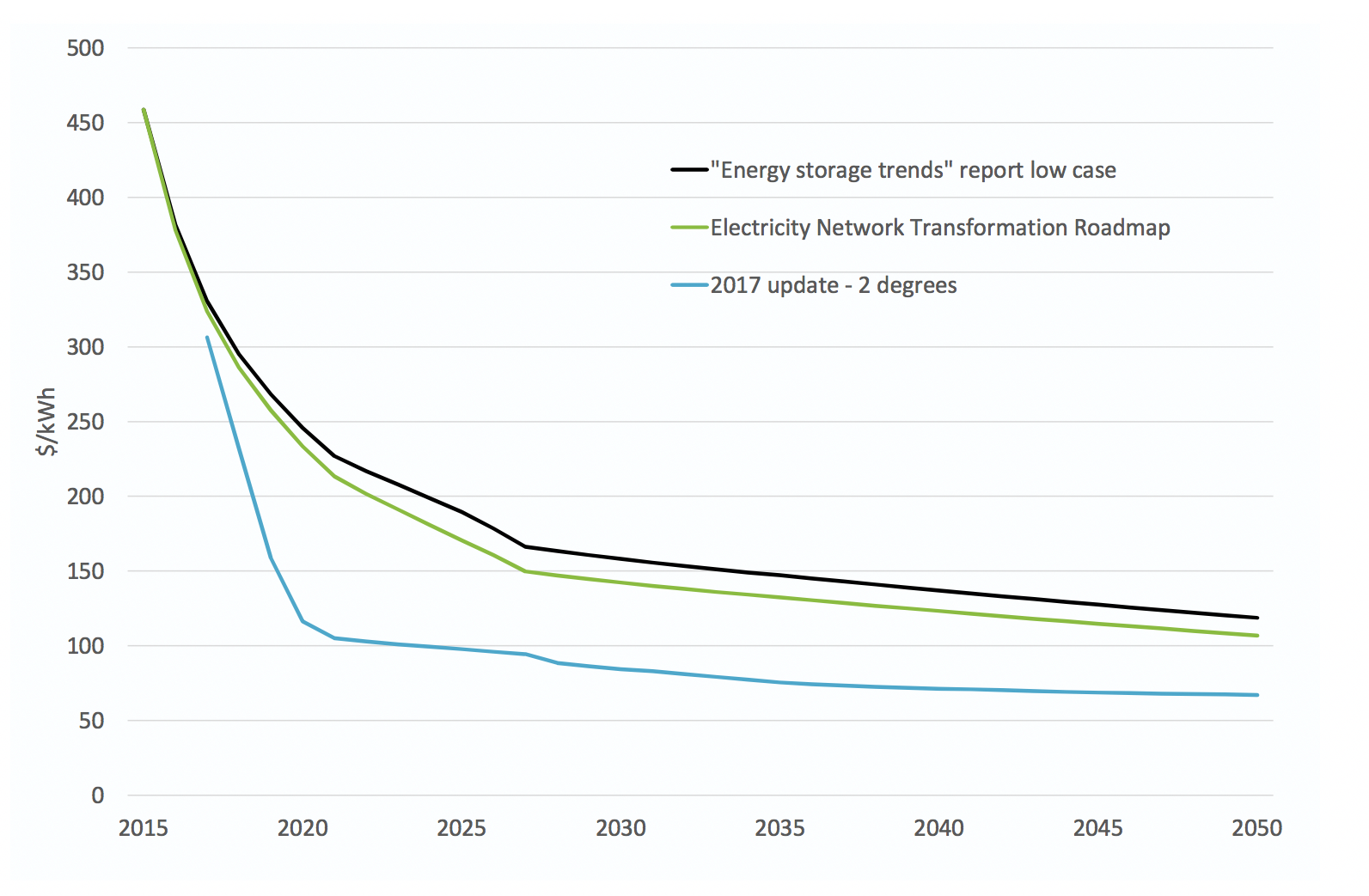

Based on increased innovation and uptake in electric vehicles, and concomitant learning in storage more generally, the CSIRO report highlights that increasingly lower costs compared to previous analysis in 2015, and when considered under the 2°C policy scenario. Interesting, the level of costs projected in 2050 is around half that of the earlier 2015 low cost projections.

Figure 13: Comparison of battery only cost projections in AUD (CSIRO, 2017).

Moreover, new business models for sharing the benefits of solar electricity production across building tenants and owners will also enable integrated solar. Interestingly this is already happening in 2018 with blockchain based technologies and entrepreneurial companies like Powerledger and LO3, and emerging trading systems using distributed artificial intelligence, like RedGrid One. Although no future projections are infallible, the CSIRO analysis points to the continued dropping cost of renewable energy, and, in combination with the squeezing of the business models of traditional fossil-based energy generators and retailers, we can see the opportunity for advancing now the support for smart digital energy as a connector, stabiliser, and enabler of new business model value.

The digital energy context in Germany

By mid-2018, coal in Germany generated about 35.1% of the country’s electricity. In comparison, renewable sources, such as solar, wind, and biomass, generated about 36.5%. At the half-year mark, it’s the first time in Germany’s history that renewables sources have generated more electricity than coal.Germany has technological leadership and pioneering work in renewable energy technologies, but is experiencing challenges with grid infrastructure capacity and digitalisation of energy transmission.

In January 2018, the German coalition government raised its clean energy target to 65 per cent back in January, up from 50 per cent (Renew Economy, 2018). Germany already reached its 2020 target and is progressing at pace to become 100% renewable by 2030. The policy shift helps maintain momentum for private sector players and keep up with market realities.

As noted above, this is considerably higher than the 36% target previously set by Australia’s National Energy Guarantee, and even Labor’s aspirational target of 50 per cent by 2030.

The 2014 Amendment of the Renewable Energy Sources Act -EEG noted that renewable energy source consumption share is set to increase to 40%-45% by 2025, to 55% - 60% by 2035, and to 80% by 2050. RES technology expansion corridors are expected to be: Onshore wind energy – 2.5 GW of net additions annually; Offshore wind energy – 6.5 GW to 7.7 GW additions until 2020 (800 MW per year); Solar PV – 2.5 GW annual additions; Biomass – 100 MW annual additions (IEA, 2014).

The success of renewable energy in Germany has been in large part to the dedication of the Government of Germany to support a number of platforms and fora to enable technological opportunities in key areas of climate and energy innovation (BMWi, 2016):

- Research and Innovation Platform: Aimed at enhanced coordination between Federal Government, the Länder, business and scientific communities and strengthened approach in transforming R&D results to innovation. The central action areas: development of energy research policy, development of new approaches, such as strategic energy system analysis, the system integration of individual technologies (particularly smart ICT systems), and the role of start-ups in the innovation process.

- Energy Transition Research Forum: Key players from the Länder, the business community, academia and civil society have been meeting since 2013 to drive forward the effective coordination and long-term direction of energy research.

- Copernicus projects: The aim is to better bridge the gap between basic research and practical applications in key areas of the energy transition. The first funding phase is focused on power grids in the context of a high share of renewables in the energy mix, storage and conversion, realignment of industrial processes to intermittent energy supply and sector coupling, and the projects are set for three years, and planned funding is up to EUR 120 million.

- Energy Systems of the Future Academies project: The purpose is to bring together 120 representatives from German science academies to develop systemic policy options for the area of basic research with a focus on the energy system of the future. This is expected to provide a scientifically sound basis for society-wide debates on Energiewende-related issues.

- Sustainable Power Grids research initiative: Joint initiative of the Federal Ministry for Economic Affairs and Energy and the Federal Ministry of Education and Research to create a necessary technological framework for the future electricity transmission and distribution infrastructure.

- Energy Storage research: Joint initiative of the Federal Ministry for Economic Affairs and Energy and the Federal Ministry of Education and Research to support the entire research chain from fundamental R&D work to practical application in the field of energy storage. So far, the initiative is formed by around 250 projects and EUR 200 million of funding (2012-2016).

- National Innovation Programme for Hydrogen and Fuel Cell Technology (NIP): Infrastructure, the Federal Ministry of Education and Research and the Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety, the industry and the scientific community, designed to speed up technology development and the process of producing marketable products. So far, more than 200 research projects with a budget of around EUR 1.4 billion for 2007 to 2016 have been initiated.

- Collaboration Programme: Energy Transition Research Alliance at the German Federation of Industrial Research Associations (AiF): Joint initiative of energy research and industrial collective research launched by the Federal Ministry for Economic Affairs and Energy specifically to strengthen the innovative capacity of non-research-focussed SMEs in the development of energy solutions. First projects started at the end of 2016 with a total funding of EUR 18 million.

- Carbon2Chem research initiative: A consortium from industry and science (including Thyssenkrupp, Linde, BASF, Covestro, AkzoNobel, Max Planck Society and Fraunhofer Gesellschaft) is trialling the conversion of smelting gas from steel production into base chemicals using renewable energy, with a funding of EUR 62 million in 2016- 2020.

- Renewable Resources funding programme: Initiative of the Federal Ministry of Food and Agriculture for the promotion of research, development and demonstration projects in the use of renewable resources as a material and for energy purposes. In 2016, combined funding of Federal Ministry of Food and Agriculture (EUR 61 million) and Energy and Climate Fund (EUR 24.6 million) was made available.

- Biomass Energy Use funding programme: R&D with a practical orientation, on forward-looking technologies and the optimisation of bioenergy processes to contribute to energy supply security. The programme was launched in 2009 and since 300 projects have been carried out with funding amounting to around EUR 44 million. EUR 61 million were available in 2016 and in addition funding of EUR 24.6 million provided from the Energy and Climate Fund.

The operators of new renewable energy plants are required to market their electricity directly in order to improve better integration into the market. This opens significant opportunities for product-market interaction and digital business model development (Bumpus and Comello, 2017).

Enabling digital energy technologies

The Digital Strategy for 2025 notes that:

“Our aim is the comprehensive and systematic use of the digitalisation potential in the fields of energy, transport, health, education and public administration; we expect this to generate considerable efficiency gains and to stimulate macroeconomic growth. The Smart Networking Strategy was adopted by the cabinet in September. Since then, a lot of information policies have been rolled out. For example, a “Smart Networking Initiative” centre of excellence has been set up, and roadshows set in motion.” (BMWi, 2017, p33).

For the energiewende to be completed, it is clear to see that digital will be an increasingly important component of new technologies and business models. Germany’s current focus on digitalisation is testament to this direction. Indeed, Germany’s digitalisation strategy highlights the opportunity for digitalisation by exploiting its existing high industrial competence in the new digital economy. They need platform expertise if they are to do so. They must combine existing product portfolios and customer contacts with the network effects of a platform. This creates an ecosystem for additional value added – with new technologies, new customer interfaces, new partners and, most importantly, new services.

Alongside some other European nations, Germany is lagging behind digital leaders in the world. In comparison to the US, where 18 percent of its digitalisation potential and leads the global field, Europe only has 12 per cent, and Germany only ten. So far, only one in four manufacturing companies in Germany believes itself to be well prepared for digitalisation. The government notes that they need to significantly boost funding for research and development in the area of digitisation of the economy. In most areas of trade and industry, this funding is only one-tenth the amount of that provided for energy or aerospace.

The BMWi notest that in the medium term it is not sufficient for Germany to be digital efficiency champion. More investment in digitalisation required but, moreover, that “a change in corporate culture is necessary: openness and courage to use digital technologies and qualified employees so as to develop new business models” (2018, p. 28). This builds on the opportunity emerging in digital energy and the ability to add value by moving away from products to data platforms, and how completely new value-added potential is arising by networking customers and cooperation partners.

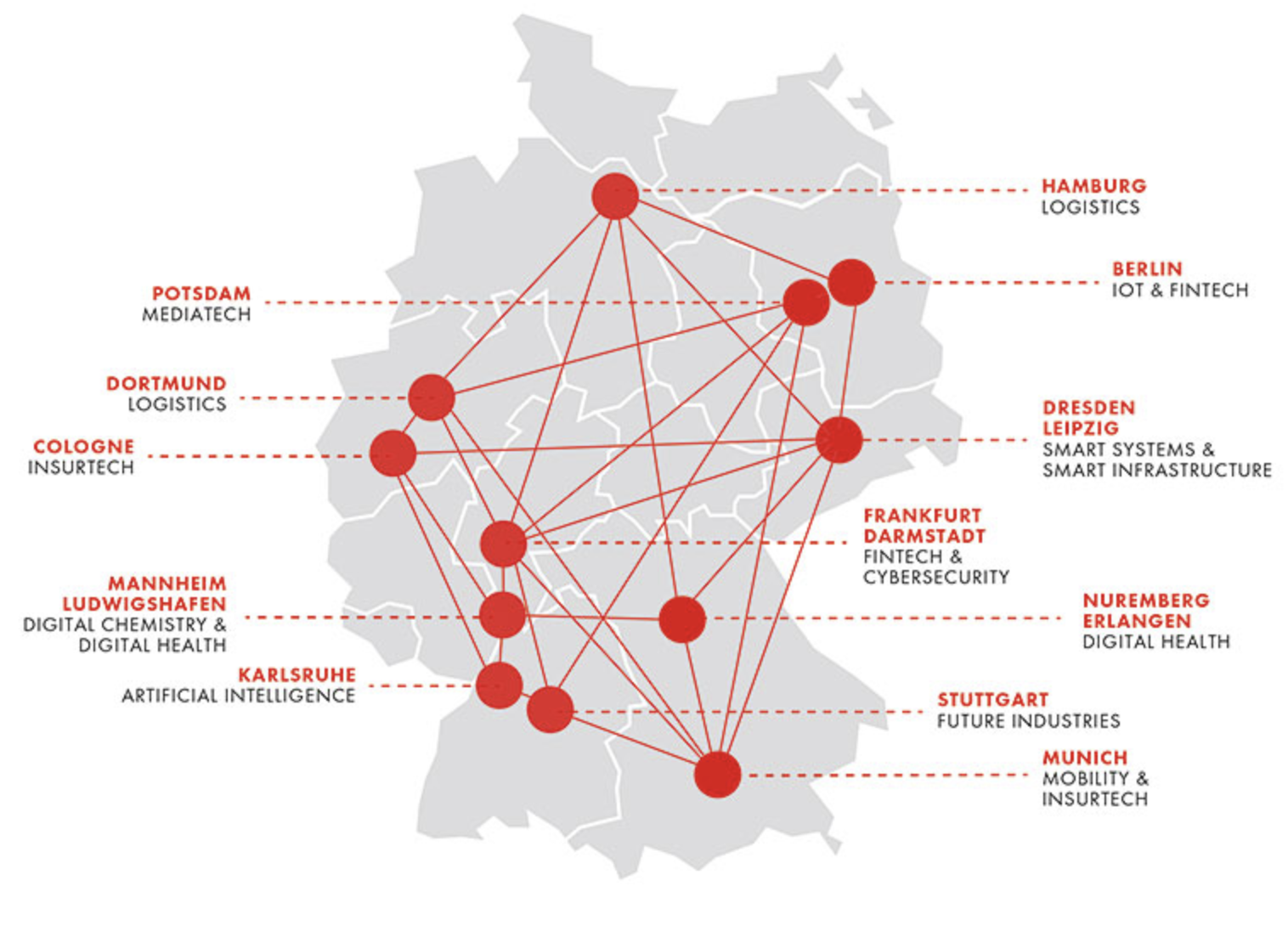

From 2014 – 2017, the German Federal Ministry for Economic Affairs and Energy also implemented the ‘Digital Agenda’. In particular the agenda included the formation of 12 ‘hubs’. Small and medium sized enterprises will be key driving forces for digital innovation:

“The aim is to help SMEs to succeed and grow in the rapidly changing conditions of a global data economy. In some sectors, such as the services sector, this initially involves measures to raise awareness of scope for digital development and resulting new value chains" (BMWi, 2017)

By developing a network of ‘Mittelstand 4.0 centres of excellence’ across the country, the government is raising awareness for the deployment of digital solutions among small and medium-sized companies. As part of Germany’s broader digital agenda, specialist digital hubs have been set up. Ten of these hubs as well as one centre of excellence for digital skilled crafts have been established so far, and more are to follow soon. Some of these hubs support the crossover between energy and digital innovation in Germany. Of particular relevance to energy, for example, is the Leipzig-Dresden hub which focuses on smart systems, Internet of Things, and energy, smart city, and e-health sectors as particular focal points (Hub, 2018). While the Leipzig Hub focuses on promoting smart infrastructure (with an emphasis on energy, smart city, e-health, and cross-sectional technologies), in Dresden the focus is on developing the hardware, software, and connectivity components needed to facilitate smart systems. The aim is to become a platform for application-based solutions for leading industries, and consequently facilitate the Internet of Things.

BMWi’s (2017) Digital Platforms paper notes that products and services increasingly contain digital value added and are getting “smart” by incorporation into intelligent and networked systems. New business models are arising in the digital environment. Completely new ecosystems with value added chains are being created in which data are an important resource. The use of digital (data) technologies gives rise to new areas of knowledge and industry: we are now seeing data-support- ed health services (e-health), using data-driven financial services (FinTechs) and have the first applications of intelligently networked energy production and supply (smart home).

Leipzig has steadily built its reputation as an attractive, aspiring location for startups. Several research institutions covering a wide range of research projects serve as the driving force behind the Digital Hub. At the same time, the site is home to strong businesses that are - often in collaboration with startups - increasingly opening up to innovation. The energy, smart city, and e-health sectors are particular focal points in Leipzig, allowing the Hub to connect the scientific community, businesses, and startups. An accelerator programme focussing on smart infrastructure, various regional cluster organisations, numerous events and innovation formats all play a supporting role in enabling this exchange. For example, partners in Leipzig include: AOK PLUS, VNG Group, Leipziger Gruppe, European Energy Exchange, enviaM, Porsche, and Arvato Systems (de:hub, 2018)

Figure 14: Digital ecosystems interconnected hubs in Germany (de:Hub, 2018)

Digital Agenda 2025 sets out even more ambitious objectives. By 2025, Germany wants to put in place a viable gigabit network (with gigabit speeds for uploads and downloads, reliable real-time transmission, and high-quality secure internet services). The government’s view is that companies and business parks need to be connected to gigabit networks as soon as possible by rolling out optical fibre network nationwide because this is a key prerequisite for introducing 5G networks (5th generation mobile phone standard). Similar to the beleaguered roll out of the National Broadband Network (NBN) in Australia, infrastructure investments in Germany are seen to be critical to avoid a situation where a lack of infrastructure is holding back digitisation innovation opportunities.

Investment Trends

Investment Trends: Australia

The stark reality of clean energy investment is that US$2.4 trillion per year is needed to keep the world on a path to a safe climate under 1.5°C (IPCC, 2018). For comparison, the first half of 2018 only saw $138.2 billion of renewable energy investments (BNEF, 2018). Investment in Australia continues to have a difficult ride with an ever-shifting landscape of climate and energy policy.

Despite this uncertainty, investment in clean energy has led to 6553 megawatts of capacity from renewable energy projects under construction or already built by May 2018; this is above the 6400 megawatts of capacity required to meet the previously set, Renewable Energy Target (RET). The RET requires 23.5 per cent of Australia's energy – or 33,000 gigawatt hours – to come from clean energy sources by 2020, with key investments to keep flowing out until 2030. However, the RET finishes in 2020, and 97% of emissions reductions mandated will be achieved through business as usual activities by this point in time. The Turnbull government’s ‘National Energy Guarantee’ (NEG), supported by the Finkel Review, was pronounced “dead” by the subsequent Prime Minister, Scott Morrison, in September 2018 (AFR, 2018), with no federal renewable energy target in its place. State governments are therefore going alone in their policies to achieve emissions reductions in line with, or beyond, Australia’s Paris Agreement commitments.

At a federal level (the focus of this briefing), investment in clean energy innovation must, therefore, come from existing sources: the Australian Renewable Energy Agency (ARENA), and the Clean Energy Finance Corporation (CEFC). ARENA and the CEFC work to drive the development and uptake of clean energy technologies in Australia. ARENA provides research, development and deployment grant funding to improve the affordability and supply of renewable energy in Australia. The CEFC focuses on investing commercially to increase the adoption of clean energy technologies and facilitate the flow of funds into the clean energy sector (Australian Government, 2017).

In 2016 the Government provided $800 million in funding to ARENA to 2022, and as of 30 June 2017, ARENA had committed approximately $1 billion to over 320 renewable energy projects. This has been matched by $2.5 billion in co-funding, making the total $3.5 billion. It is unclear if ARENA will receive funding post-2022, and according to the former CEO, Ivor Frischknecht, who noted ARENA would no longer be needed if battery storage and demand management matched the rapid uptake of wind and solar in the National Electricity Market; essentially providing the backup for intermittency in renewables (AFR, 2017).

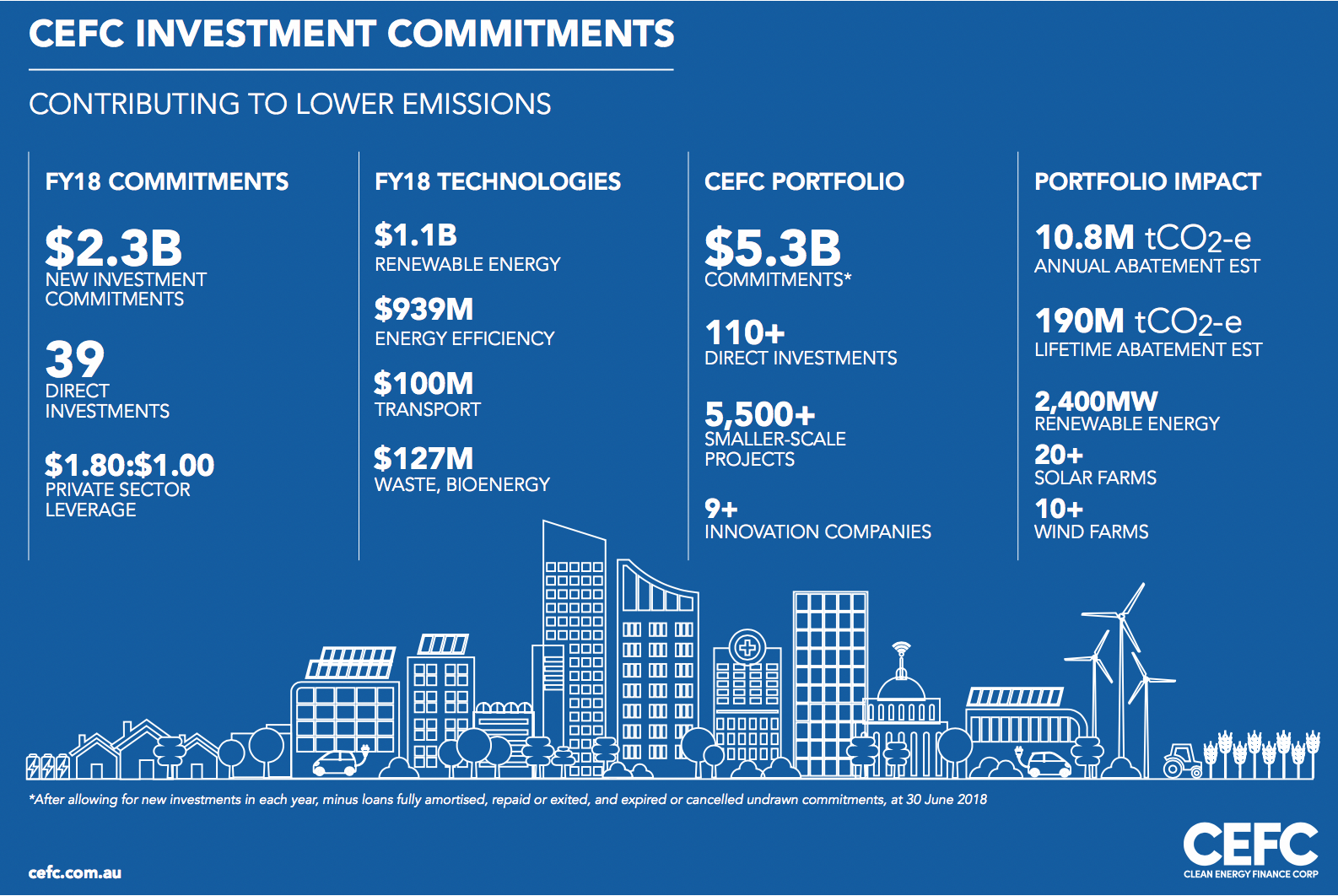

The CEFC was entrusted with $10 billion in public funds. Over five years of investing, CEFC commitments have contributed a total project value of $19 billion to clean energy projects Australia-wide. They have directly invested in more than 110 individual transactions and delivered finance for more than 5,500 smaller-scale projects. Each dollar of CEFC investment commitments has been matched by more than $1.80 of private sector finance.

In FY18, the CEFC invested in 10 large-scale solar projects, and four wind farms, to deliver an additional 1,100MW in clean energy Australia-wide. We have now financed more than 20 large-scale solar projects and more than 10 wind farms Australia-wide, including our most recent investment in Tasmania’s largest wind farm, at Granville Harbour, which closed just after year end. Together these projects are targeting more than 2,400MW of additional renewable energy, sufficient to power more than 800,000 homes (CEFC, 2018).

In addition to investing in larger projects, the CEFC’s venture capital finance for innovative clean energy companies has seen continued significant growth between 2016 and 2018 (CEFC, 2018). A significant component has been in the Clean Energy Innovation Fund, which has provided over $56m in finance to 9 companies, and in combination with ARENA, a total of $140m in project value.

An example of the CEFC’s investment in digital energy is its debt finance of $35m to intelliHUB; a subsidiary of the global smart metering company, Landis+Gyr, aiming to accelerate the use of smart meters, extending the benefits of distributed clean energy to Australian households and businesses.

Figure 15: CEFC FY18 commitments.

Private Sector Clean Energy Financing

Large scale renewable energy investment is being increasingly covered by project finance from mainstream banks and corporate power purchase agreements. A clear sign of the maturity of investment in this market is the role of corporate finance investing in renewable energy project portfolios. Although Australia is a nascent market, activity is beginning to pick up, due to expensive wholesale power prices and strong renewable resources (BNEF, 2018).

Cost declines have made renewables cost-competitive with wholesale power prices and more traditional sources of electricity, and as a result corporations are locking into fixed, long-term clean energy contracts to hedging against volatile prices in the wholesale market. Investors are voting with their money and backing more than $20 billion in renewable projects as Australia moves to a less carbon-intensive economy. As of October 2018, For the 73 large scale projects in construction, there is currently $18.6 billion in investment, adding 11,586 MW of new renewable energy capacity to the system (Clean Energy Council, 2018).

Private sector financial engagement with clean energy startups also comes in the form of venture capital and corporate venture capital. Two prominent venture capital funds in Australia have official ties into clean energy entrepreneurship policy: Southern Cross Venture partners with ARENA’s Venture Capital Fund, and Artesian Venture partners with the CEFC’s Clean Energy Seed Fund.

The Southern Cross Renewable Energy Venture Capital Fund (REVC) is a venture capital fund looking for opportunities to partner with renewable energy entrepreneurs with global aspirations. It has committed capital of up to $120 million with 50% Softbank China Capital (SBCVC) and 50% from ARENA. The fund managers note the equity investment is followed by targeted support to enable catalysing the right connections, bringing the lessons of experience, acting as a trusted partner, and sharing in the vision of co-founders to build great companies.

What does this context mean for digital energy technologies and entrepreneurs? Firstly, it means that early stage support through government finance that would otherwise be placed into generation technologies, can now be deployed in the next wave of innovative technologies that aim to optimise the existing generation assets already being deployed.

Secondly, it shows that startup clean energy entrepreneurs have less opportunity to compete with existing generation technologies due to cheap costs, and instead must focus on disruptive business models (e.g. new retailers), software and IoT plays, and the confluence of data analytics and energy. However, despite growing interest in private sector capital deployment to clean energy startups, there is still a dearth of capital associated with large ideas that are potentially highly transformative:

“We have more good deals than capital available” - Senior VC investor, A-Lab Incubate 2018

Thirdly, it means that capital institutions are starting to enable a linked investment chain from very early stage to later stage companies (see Figure 15).

Figure 16: Capital providers assisting clean energy startups in Australia (green) and Germany (Red) as startups navigate the valley of death (source: Author and Acceleratenergy White Paper, 2016)

The Clean Energy Seed Fund attracted $26 million in finance, including a $10 million cornerstone commitment from the CEFC through the Clean Energy Innovation Fund. The Clean Energy Seed Fund targets scalable, high growth potential start-ups, encouraging innovation and creating opportunities in the development of clean technology. It will invest in startups at seed stage via dedicated clean energy accelerators such as EnergyLab which is supported by Climate-KIC Australia. In order to have successful startup outcomes in the form of a material liquidity event (e.g. IPO, or acquisition, i.e. ‘exit’), there needs to be a pipeline of quality, investable ideas that are placed in a structured programme geared towards commercialisation. It’s estimated that of 10,000 applicants to an incubator program, 1000 will be accepted and just 50 will exit with a viable business (Acceleratenergy, 2016).

Corporate venture capital is strong in the US and Europe, with companies like ABB having CVC arms, like ABB Technology Ventures, who invest in early stage clean energy startups. Corporate venture seems to be increasing in Australia with companies like Energy Australia making equity investments in digital energy companies like RedBack Technologies.

Material liquidity events - where investors invested in technology companies - recoup their financial interests are seen to be much stronger in Germany than Australia. In the KPMG survey, 40% respondents noted that in Germany would see the biggest increases in M&A activity expected in 2019, as compared to only 5% who viewed Australia as the most attractive (40% also viewed China, 26% the UK 21%; and India 15%)

For long term investment, a lack of stable energy policies is still a blocker for long term transformative investment. “The current lack of long-term policy certainty is the biggest blocker,” said Ted Surette, a partner with KPMG Australia. “There have been multiple changes in policy over the past 10 to 15 years. The industry, the federal government and most market participants in Australia are all of the view that we need a nationwide energy policy that brings together federal and state requirements. This is the number one issue facing the country right now” (KPMG, 2018).

Australia’s growing levels of utility and residential renewable energy is also providing challenges for grid integration. Coal is down 20 percent since 2008 and wind power up 325 percent in the same time period according to the Australian Energy Market Operator (AEMO). The increase in intermittent renewables and requirements for flexible demand for grid stability is a cause for concern for those basing business models on more renewable energy generation. however, while integrating such a complex energy mix can cause headaches for end users and government policy-makers, it gives investors opportunities. According to KPMG “Investors want to take advantage of this disruption — they’re looking at sophisticated service models, blockchain applications and fringe-of-grid solutions because of the geography,” (Ted Surette, KPMG, 2018.) Digital energy technology companies in Blockchain and AI therefore may find opportunities in solutions that enable improved optimisation and integration.

Investment Trends: Germany

A steady policy environment for renewables has laid the foundation for well integrated renewable energy generation. To support regional integration supported by digitalisation, the “Smart Energy Showcases - Digital Agenda for the Energy Transition” are known as the SINTEG programme is being rolled out. The projects seek to develop blueprints for a smart renewables-based electricity supply that can then be rolled out on a wider scale, and build the smart digital energy economy of the future.

Under the SINTEG funding programme, more than 500 million euros will be invested in the digitisation of the energy sector. The Federal Ministry for Economic Affairs and Energy is also providing more than €200 million in funding for five energy showcase regions. The SINTEG funding programme aims to set up large-scale showcase regions for developing and demonstrating model solutions that can deliver a secure, efficient and environmentally compatible energy supply with electricity being generated to a large extent from volatile sources such as wind or solar. The solutions developed are then to be rolled out on a wider scale.

The programme places a clear focus on building smart networks linking up the energy supply and demand sides, and on the use of innovative grid technology and operating strategies. It thus addresses key challenges of the energy transition including the integration of renewables into the system, flexibility, digitisation, system security, energy efficiency and the establishment of smart energy systems and market structures. The project makes an important contribution to moving forward the digital transformation and the energy transition. Adding the investment that will be made by the private-sector companies involved, a total of €500 million in investment will be available for bringing about the smart energy supply of the future (BMWi, 2016).

A key enabling factor here is regulatory: in order to make it possible for the participants of the SINTEG programme to test new technologies, procedures and business models in practice without facing financial disadvantages, the Federal Ministry for Economic Affairs and Energy has developed a fixed-term ordinance, which provides these participants with room for conducting experiments. The change in regulation aims to enable the possibility to learn from practical tests so that the existing legal framework can be updated.

The SINTEG programme includes five digital energy related activities:

1. The ‘C/sells’ showcase is based on an energy system organised into ‘cells’, varying in size from individual sites to networks, and organised through energy exchanges between areas of high and low demand and supply, including incentives for improving flexibility in distribution grids and balancing energy via the heat and transport sector.

2. Data from some 140,000 meters is to be used in the ‘Designnetz’ model region which showcases the optimised use of flexibility options that benefit the market, the grid and the overall energy system

3. The ‘Enera’ showcase is experimenting with decentralised installations to provide regional ancillary services, to improve the reliability of the electricity supply, and use a data and ICT framework to enable electricity trading.

4. The ‘NEW 4.0’ showcase brings together the city of Hamburg – a large centre of demand – and the state of Schleswig-Holstein – a key centre for the generation of wind energy. by using state-of-the-art technology and improved market rules, supply and demand are to be balanced in the best possible way.

5. The ‘WindNODE’ showcase aims to efficiently combine renewable energy generation, electricity grids and energy users through digital networking.The project focuses on the use of flexibility options at all levels. The clear goal of the project is to develop innovative products and services that complement the traditional business of selling volumes of energy, and to introduce consumer protection and data security standards so that people and companies that are part of the interconnected energy system are effectively protected against misuse of their data, and so that the highest possible level of data security is guaranteed.

Note: The Ministry of Economic Affairs and Energy (BMWi, EUR 1.1 billion in 2016) together with the Energy and Climate Fund (ECF, EUR 2.1 billion in 2016) contribute ~80% of the total expenditure, followed by the other Federal Ministries summing-up the remaining 20% including the Federal Ministry of Education and Research (BMBF, EUR 442 million), Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety (BMUB, EUR 250 million); Federal Ministry of Transport and Digital Infrastructure (BMVI, EUR 91.5 million); and Federal Ministry of Food and Agriculture (BMEL, EUR 24.7 million). (EU 2018)

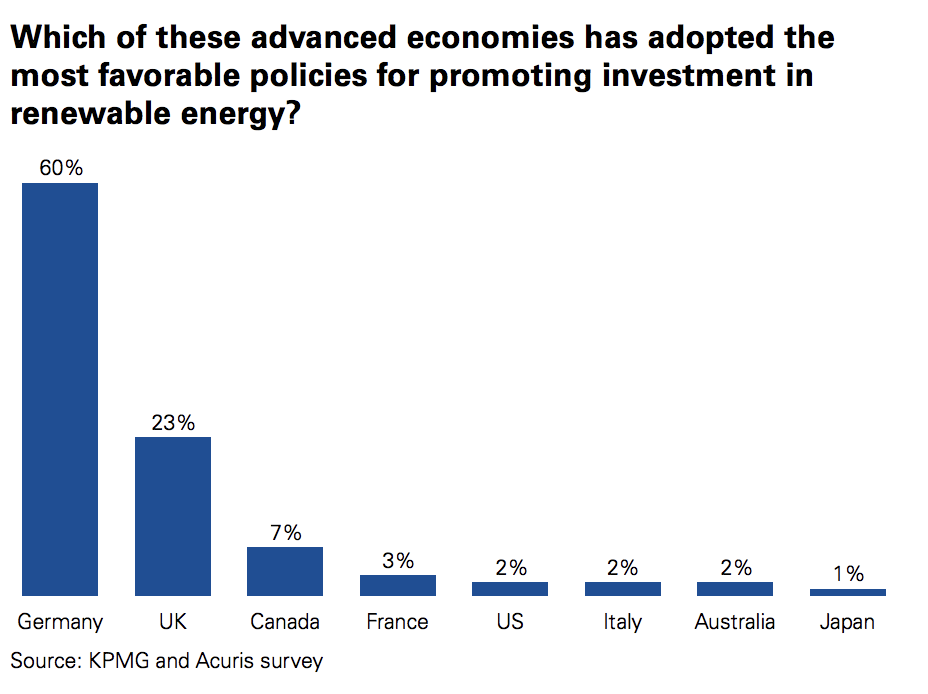

Germany is placed well for private sector energy funding toward 2030. According to KPMG’s Great Expectations report (2018): 60% of respondents say Germany’s policies are the most favorable among advanced economies for investment in renewables due to its stable regulatory landscape and continuous development plans for renewables. Respondents expect the country to see the biggest rise in M&A activity in the next 12 months, ranking it the western European country where they are most likely to invest.

Progressive energy policies are the key to Germany’s highly anticipated M&A activity — it takes the top spot as the western European country most respondents (43 percent) are likely to invest in over the next 12 months. Germany’s approach, as stated by the Federal Ministry for Economic Affairs and Energy, is to “fundamentally alter Germany’s energy supply: away from nuclear energy and fossil fuels and towards renewable energy. By 2025, at least 40 to 45 percent of our energy is to be sourced from renewable energy, and we want to raise this to at least 80 percent by 2050.” (“Ready for the next phase of the energy transition“ (German Federal Ministry for Economic Affairs and Energy, 2018).

For digital, however, broader infrastructure requirements exist: between 2018 and 2025, around €10 billion in public funding – and a lot more in private investment – will be needed. Part of the funding will come from the new ‘fund for future investment in digitisation’ which is about to be set up. In order to stimulate demand, Germany needs to provide small and medium-sized companies and other social and economic organisations based in rural and underserved areas that use innovative solutions with ‘gigabit’ vouchers – fixed-term grants for getting gigabit connections (German Federal Ministry for Economic Affairs and Energy, 2017).

For long term ambitions to 2050, Germany is the clear winner among advanced economies when it comes to promoting investment in renewable energy, according to 60 percent of respondents. “The German government and its long-term support for renewables is what got them where they are today,” says the finance director of an Indian utility. “In this sector, it’s extremely important to have government support and Germany has that.”

Solar PV, in particular, is undergoing something of a renaissance, particularly in Germany, according to KPMG (2018) in Germany’s Annette Schmitt: “There wasn’t a very favorable subsidy regime for large-scale solar PV in Germany for a long time. It was mostly smaller-scale rooftop installations. Now, with the transition from FITs to an auction-based support regime, larger-scale projects are coming back and, contrary to onshore wind, there are still many sites where larger solar PV can be put into operation. “Germany has been leading the implementation and production of solar energy,” says the M&A director of a US-based independent power producer. “They have been able to roll out some of the biggest solar energy projects in the past 5 years. I consider Germany an attractive destination for investing in this form of renewables.”

The favourable policy position taken Germany for investors has created a firm foundation on which future investment toward 2030 and 2050 can be built. The KPMG survey results bare out the global sentiment on the strong leadership of Germany for clean energy investment, as compared to Australia. This is a major opportunity for Australia to learn from Germany.

Figure 16: Survey results of which countries have the most favourable policies for promoting investments in renewable energy (KPMG, 2018).

Germany has supported renewable technologies through its Energiewende policy framework for more than 7 years. However, KPMG in Germany’s Annette Schmitt says that investors should take heed of the changing subsidy landscape: “Strike prices and tenders across all technologies are coming down, so it is a much tougher market these days. Everyone who is playing in the German market, or wants to play in the German market, has to think about how to respond” (KPMG, 2018).

Fig 17: Countries that are most attractive for investment according to the KPMG, (2018) survey results.

In comparison to Germany, Australia is not seen as an attractive opportunity for global investors in solar PV. Germany is at the heart of investor activity due to its stable regulatory landscape and continuous development plans for renewables. Out of a survey of 200 senior- level investors in renewable energy (Q3, 2017) respondents noted they expect Germany to see the biggest rise in M&A activity, globally, in the next 12 months, ranking it the western European country where they are most likely to invest (KPMG, 2018, p6). 32% percent of respondents saw Germany attracting the most investment in the near future, compared to only 1% for Australia.

Ecosystem Support

Ecosystem support in Australia

Startup ecosystems are complex and multi-dimensional. Supporting startups can bring multiplier effects to the economy and, in the case of critical landscape issues like climate change and the need for cleaner energy, enable future-proofing of positive socioeconomic conditions.

For example, the startup scene in Victoria could create $4 billion of economic value over the next several years. In a context where an estimated 40% of jobs could become obsolete within the next decade or so, this type of economic growth is essential to sustaining job security and economic opportunity (Startup Genome, 2018). When startups become scaleup firms (as a few do) they create jobs both directly and indirectly. This is important as the economy transitions from value created through boom and bust cycles, including mining and real estate, to a knowledge economy driven by innovation and technology (including potentially clean energy fuelled manufacturing).

Technology jobs have a much higher multiplier effect than other sectors. Every technology job in a startup has been estimated by economist Enrico Moretti to create an additional five jobs in other parts of the economy, both skilled and unskilled. This is three times higher than manufacturing jobs. So although technology startups may strike policymakers and others as small, especially when compared to large firms in mining and the sheer size of the real estate sector, they have a far higher reaching economic impact.

According to the analysts, Startup Genome, there are nine ingredients that factors that determine a healthy entrepreneurial ecosystem:

-

Capital silicon

-

Know-how

-

Rebellion

-

Market

-

Talent

-

Global mindset and communication skills (English, etc.)

-

Culture

-

Infrastructure

-

Regulations

Supporting new energy entrepreneurship in the context of digital disruption is highlighted in the CSRIO, (2018) report:

“As a mid-sized market, it is critical that Australia defines its own path to success at digital innovation, rather than attempting to emulate the breadth of Silicon Valley or the scale of China. Australia is most likely to succeed if it focuses on producing new digital products and services for industries in which it already has a global competitive advantage — thanks to its natural resources endowment, strong institutions, diverse and highly skilled workforce, and existing infrastructure and customer base.”